Creating A Personalized Debt Repayment Plan: Step-by-Step Guide

Are you feeling overwhelmed by your debt and unsure of where to start? Look no further than the “Creating A Personalized Debt Repayment Plan: Step-by-Step Guide.” This comprehensive resource is designed to assist individuals who are looking for practical and effective ways to tackle their debt. Whether you have student loans, credit card debt, or a combination of both, this guide will walk you through the process of creating a personalized repayment plan that suits your unique financial situation. With easy-to-follow steps and practical tips, you’ll be on your way to financial freedom in no time. Say goodbye to stress and hello to a brighter financial future with the “Creating A Personalized Debt Repayment Plan: Step-by-Step Guide.”

1. Assess your current financial situation

Gather all your financial statements

Before diving into creating a debt repayment plan, it is essential to have a comprehensive understanding of your financial situation. Start by gathering all your financial statements, including bank statements, credit card statements, loan documents, and any other relevant paperwork. This will give you a clear picture of your current financial standing.

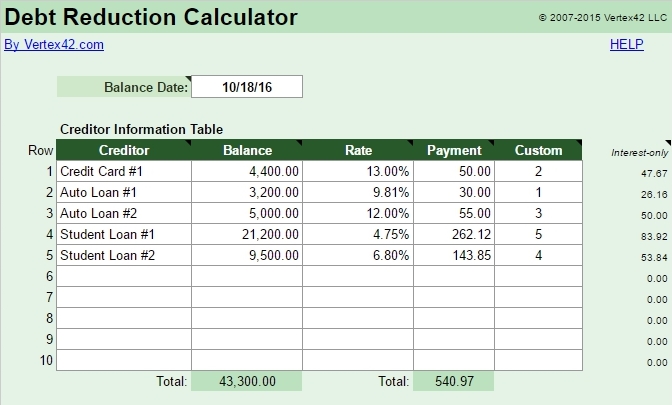

Calculate your total debt

Once you have all your financial statements in front of you, it’s time to calculate your total debt. Add up all your outstanding balances on credit cards, loans, and any other debts you may have. Knowing the exact amount you owe is crucial for creating an effective debt repayment plan.

Determine your income and expenses

Next, evaluate your income and expenses. Look at your pay stubs, freelance income, and any other streams of income you may have. Subtract your monthly expenses, including rent or mortgage, utilities, groceries, transportation costs, and any other recurring bills. This calculation will help you understand how much income you have available to allocate toward debt repayment.

Analyze your financial habits

To create a successful debt repayment plan, it’s important to analyze your financial habits. Take a close look at your spending patterns and identify any areas where you tend to overspend or make unnecessary purchases. Understanding your financial habits will help you make informed decisions and make necessary adjustments to your lifestyle to achieve your debt-free goals.

2. Set clear goals

Define your debt-free date

Setting a clear debt-free date is a crucial step in your debt repayment journey. It gives you a specific target to work towards and helps you stay focused and motivated. Take into account your current total debt, your income, and your expenses to determine a realistic deadline for becoming debt-free. Remember to be realistic but also challenge yourself to make meaningful progress towards your goal.

Determine how much you want to pay off

Once you have established your debt-free date, it’s time to determine how much you want to pay off. This could be a specific dollar amount or a percentage of your total debt. Setting a specific target will help you track your progress and make adjustments to your repayment plan if necessary.

Establish short-term and long-term goals

Apart from a debt-free date and target amount, it’s essential to set short-term and long-term goals that act as milestones on your debt repayment journey. Short-term goals could include paying off a certain debt within a few months, while long-term goals could be saving a specific amount of money by a certain date. Having these goals in place will help you stay motivated and give you a sense of accomplishment along the way.

Prioritize your debts

As you define your goals, prioritize your debts based on interest rates, monthly payments, and the overall impact they have on your financial well-being. Consider tackling high-interest debts first to minimize the amount of interest you accrue over time. Prioritizing your debts will help you allocate your resources effectively and create an efficient repayment strategy.

3. Evaluate debt repayment strategies

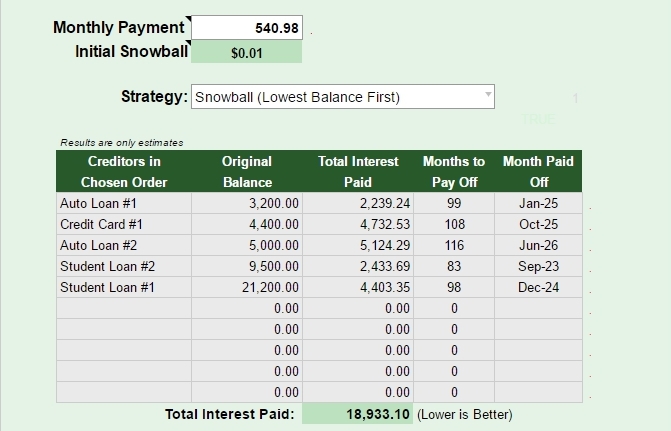

Snowball method

The snowball method is a popular debt repayment strategy that focuses on paying off the smallest debts first while making minimum payments on all other debts. As you pay off each debt, the freed-up cash flow is then used to tackle the next smallest debt. This method provides a psychological boost as you see debts being eliminated, which can help you stay motivated throughout your repayment journey.

Avalanche method

The avalanche method, on the other hand, prioritizes debts based on their interest rates. Start by paying off the debt with the highest interest rate while making minimum payments on the rest. Once the highest-interest debt is paid off, redirect the freed-up funds toward the debt with the next highest interest rate. This method saves you more money in the long run by minimizing the amount of interest paid.

Debt consolidation

If you have multiple debts with high-interest rates, debt consolidation might be a suitable option for you. Debt consolidation involves taking out a loan or opening a new credit card with a lower interest rate to pay off all your existing debts. This consolidates all your debts into one, making it easier to manage and potentially reducing your overall interest payments.

Balance transfer

If you have credit card debt with high-interest rates, a balance transfer might be a viable option. Many credit card companies offer promotional periods with low or no interest on balance transfers. By transferring your existing balance to a new credit card with a lower interest rate, you can save money on interest payments and expedite your debt repayment progress.

Debt settlement

For individuals facing severe financial hardship, debt settlement may be an option to consider. Debt settlement involves negotiating with your creditors to reduce the amount you owe, often in exchange for a lump sum payment or a structured repayment plan. It’s important to note that debt settlement can have long-term consequences on your credit score and should only be considered as a last resort.

Credit counseling

Credit counseling agencies offer assistance and guidance to individuals struggling with debt. They can help you evaluate your financial situation, create a budget, and develop a personalized debt repayment plan. Credit counseling agencies may also negotiate with your creditors on your behalf to secure more favorable repayment terms. It’s crucial to research and choose a reputable credit counseling agency to ensure you receive reliable advice.

4. Create a budget

Track your income and expenses

Creating a budget is a critical step in managing your finances and staying on track with your debt repayment plan. Start by tracking your income and expenses. Keep a record of all your sources of income and categorize your expenses, including fixed expenses (rent, utilities), variable expenses (groceries, entertainment), and debt payments.

Identify areas where you can cut back

Once you have a clear understanding of your income and expenses, identify areas where you can cut back and reduce unnecessary spending. This could include eating out less frequently, canceling unused subscriptions, or finding more affordable alternatives for certain expenses. Cutting back on expenses will free up more money that can be allocated toward debt repayment.

Allocate funds for debt repayment

Make debt repayment a priority in your budget. Set aside a specific amount each month dedicated solely to paying off your debts. This ensures that you are consistently making progress toward your goals. Adjust your budget as needed to accommodate for changes in income or expenses.

Include an emergency fund in your budget

In addition to debt repayment, it’s crucial to include an emergency fund in your budget. An emergency fund acts as a safety net, providing financial security in case of unexpected expenses or emergencies. Aim to save three to six months’ worth of living expenses and continue contributing to your emergency fund even as you focus on debt repayment.

5. Negotiate with creditors

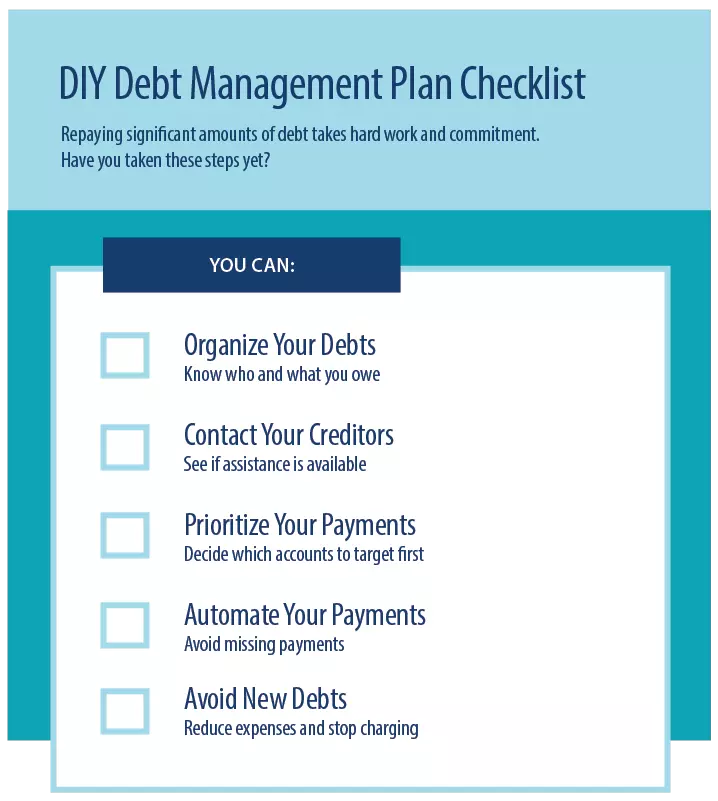

Contact your creditors

If you’re struggling to meet your debt obligations, it’s important to reach out to your creditors. Contact them directly to explain your financial situation and discuss potential options for repayment. Many creditors are willing to work with you to create a more manageable repayment plan.

Explain your financial situation

When speaking to your creditors, be open and honest about your financial situation. Explain any circumstances that have led to financial hardship and provide relevant supporting documentation if necessary. Building a good rapport with your creditors can increase your chances of receiving favorable repayment terms.

Request interest rate reductions

Ask your creditors if they are willing to reduce your interest rates as part of your debt repayment plan. Lower interest rates can significantly reduce the overall cost of your debt and make it easier to pay off. Be prepared to negotiate and provide reasons why you believe an interest rate reduction is warranted.

Explore options for lower monthly payments

If your current monthly debt payments are overwhelming, explore options for lower monthly payments. Some creditors may be willing to extend the repayment term or adjust the monthly payment amount, giving you more breathing room in your budget.

Consider debt repayment plans offered by creditors

Many creditors offer debt repayment plans that can help you structure your payments and make them more manageable. These plans may come with reduced interest rates or fixed payment amounts over a set period. Explore these options and consider their benefits and drawbacks before making a decision.

6. Consider additional sources of income

Explore part-time job opportunities

To accelerate your debt repayment progress, consider exploring part-time job opportunities. Taking on an additional job, even for a few hours a week, can provide an extra source of income that can be directly allocated toward debt repayment.

Start a side business

If you have a particular skill or hobby, consider starting a side business to generate additional income. This could involve freelancing, selling handmade crafts or products, providing consulting services, or offering tutoring. Starting a side business can not only help you earn extra money but can also be a rewarding and fulfilling way to pursue your passions.

Monetize your hobbies or skills

Take a closer look at your hobbies or skills and explore ways to monetize them. For example, if you enjoy photography, consider offering photography services for events or selling prints online. If you’re skilled in graphic design, offer your services for freelance projects. By leveraging your existing skills and interests, you can create an additional income stream to aid in your debt repayment journey.

Rent out assets or space

If you have assets or extra space, consider renting them out to generate additional income. This could include renting out a spare room on a short-term rental platform, leasing out equipment or tools you rarely use, or even renting out your car when it’s not in use. Assess your assets and determine if there are any opportunities to generate passive income to support your debt repayment.

7. Implement your debt repayment plan

Pay more than the minimum payment

To make substantial progress in paying off your debts, it’s important to pay more than the minimum payment whenever possible. By paying more each month, you reduce the amount of interest you accrue and accelerate the repayment process. Even if it’s just a small increase, every extra dollar counts and adds up over time.

Focus on one debt at a time

While it’s important to make minimum payments on all your debts to avoid penalties, it’s beneficial to focus any additional funds on one debt at a time. This is often referred to as a debt snowball or debt avalanche approach. Choose either the smallest debt (snowball method) or the debt with the highest interest rate (avalanche method) and allocate extra funds towards paying it off. Once that debt is fully paid, move on to the next one until all your debts are eliminated.

Automate payments

To ensure consistent and timely debt repayments, consider setting up automatic payments. By automating your payments, you eliminate the risk of forgetting to make a payment and potentially incurring late fees. This also ensures that debt repayment remains a priority in your budget.

Monitor your progress regularly

Regularly monitoring your progress is crucial to stay motivated and on track with your debt repayment plan. Keep track of the amount paid off, the debts remaining, and the progress towards your goals. You can use spreadsheets or budgeting apps to track your progress visually, making it easier to stay motivated and see the positive impact of your efforts.

8. Stay motivated and disciplined

Celebrate small victories

Throughout your debt repayment journey, it’s important to celebrate small victories along the way. As you make progress in paying off your debts, take time to acknowledge your achievements and reward yourself for reaching important milestones. This will help you stay motivated and remind yourself of the positive impact of your hard work.

Stay accountable

Accountability plays a significant role in staying on track with your debt repayment plan. Share your goals with a trusted friend or family member who can hold you accountable and provide support and encouragement. Consider joining online debt repayment communities or forums where you can connect with others who have similar goals.

Find support from friends and family

Don’t underestimate the power of support from friends and family. Surround yourself with positive influences who understand your financial goals and can provide encouragement when needed. Having a strong support system can make a significant difference in staying motivated and focused on your debt-free future.

Reward yourself for reaching milestones

As you make progress in your debt repayment plan, remember to reward yourself for reaching milestones. This doesn’t have to be extravagant or expensive; it could be something as simple as treating yourself to a movie night or buying a small item you’ve been eyeing. Recognizing your hard work and treating yourself occasionally will help maintain your motivation and keep you committed to your financial goals.

Stay committed to the plan

Creating a debt repayment plan is just the first step; the key to success lies in staying committed to the plan. Be disciplined with your budget, regularly track your progress, and remind yourself of the long-term benefits of becoming debt-free. It may require sacrifices and adjustments along the way, but staying committed will ultimately lead you to financial freedom.

9. Deal with setbacks

Be prepared for unexpected expenses

Setbacks are inevitable in any journey, including your debt repayment journey. Be prepared for unexpected expenses by creating an emergency fund (as mentioned in step 4). Having a financial cushion will help you navigate unexpected situations without derailing your progress.

Adjust your repayment plan if necessary

If you encounter a setback such as a significant unexpected expense, reassess your repayment plan and make adjustments as necessary. It may be necessary to temporarily pause aggressive debt repayment or reallocate funds to address the immediate issue. The important thing is to remain adaptable and flexible while consistently working towards your goal.

Seek professional help if needed

If you find yourself struggling to manage your debts or facing complex financial challenges, seeking professional help can offer valuable guidance. Consider consulting with a financial advisor, credit counselor, or an attorney specializing in debt management. They can provide expert advice tailored to your specific situation and help you navigate any complicated issues.

Don’t get discouraged by setbacks

Setbacks are not a reflection of failure; they are a natural part of the journey toward debt freedom. Don’t let setbacks discourage you or make you feel defeated. Instead, view them as opportunities to learn and grow. Stay positive, stay committed, and remember that setbacks can often be overcome with determination and perseverance.

10. Celebrate your debt-free future

Plan for financial freedom

As you approach your debt-free future, take the time to plan for your financial freedom. Consider what you want to achieve with your newfound financial stability. Set new goals, whether they are saving for a dream vacation, investing for the future, or pursuing a lifelong passion. Having a clear vision of your financial future will help you stay motivated and continue making wise financial decisions.

Learn from your debt repayment journey

Reflect on your debt repayment journey and identify the valuable lessons you have learned along the way. Recognize the financial habits that may have contributed to your debt and make a conscious effort to avoid repeating them. Use this opportunity to develop new, healthy financial habits that will serve you well in the future.

Establish good financial habits

Now that you have achieved debt freedom, it’s crucial to maintain good financial habits to stay on a solid financial path. Continue budgeting, tracking your expenses, and being mindful of your spending. Consider saving for emergencies, retirement, and other long-term financial goals. By establishing and maintaining good financial habits, you can enjoy the benefits of your hard work and maintain a positive financial future.

Set new financial goals

With your debt behind you, take the opportunity to set new financial goals. Whether it’s saving for a down payment on a house, starting a business, or investing in your child’s education, having clear goals will help you stay focused and continue building wealth. Regularly revisit and reassess these goals to ensure they remain aligned with your evolving financial priorities.

In conclusion, creating a personalized debt repayment plan requires a thorough assessment of your financial situation, clear goal-setting, and the implementation of effective strategies. By assessing your financial habits, prioritizing debts, creating a budget, exploring additional sources of income, and staying motivated throughout the process, you can achieve your goal of becoming debt-free. Remember that setbacks may occur along the way, but with careful planning, determination, and the support of others, you can celebrate a debt-free future and establish good financial habits for the long term.

© 2015-2023 by burdenofdebt.com, a LIVenture. All rights reserved. No part of this document may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of LiVentures LLC.