Which Debts Are Not Extinguished By Bankruptcy?

If you find yourself in a financial struggle, bankruptcy can be a potential lifeline. It offers a fresh start by wiping out most of your debts. However, it’s important to understand that not all debts can be extinguished through the bankruptcy process. In this article, we will explore the types of debts that are not affected by bankruptcy, providing you with the knowledge you need to make informed decisions about your financial future. So, let’s dive into the world of bankruptcy and unravel the debts that persist even after declaring bankruptcy.

Student Loans

Federal student loans

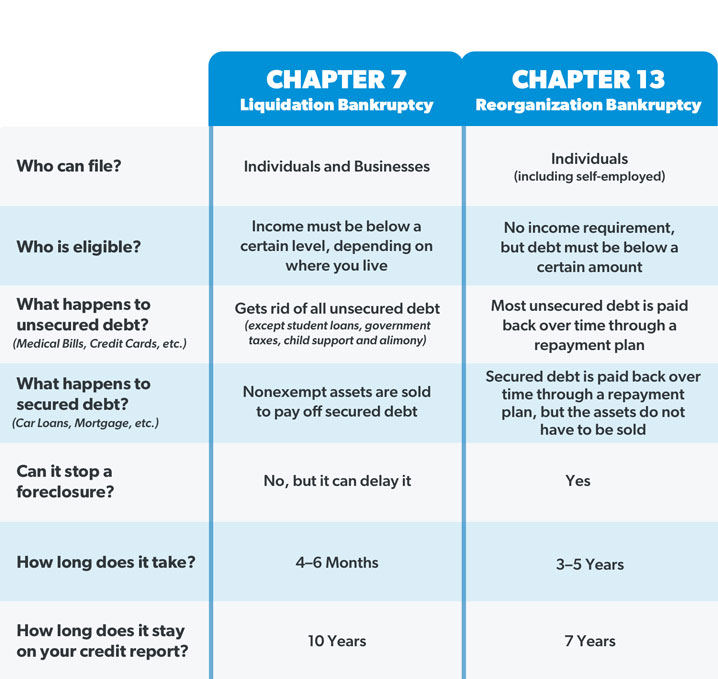

Bankruptcy does not eliminate federal student loans. These loans are backed by the government and have specific protections in place. Although filing for bankruptcy can provide temporary relief from making payments, the debt will not be discharged in most cases. However, there are options available, such as income-driven repayment plans, loan forgiveness programs, or deferment/forbearance, which can help alleviate the financial burden.

Private student loans

Similar to federal student loans, private student loans are generally not dischargeable through bankruptcy. Lenders of private student loans have more flexibility in pursuing repayment, and the decision to discharge these debts lies with the bankruptcy court. However, it is worth noting that some rare circumstances could potentially allow for the discharge of private student loan debt. Consulting with a bankruptcy attorney would be advisable in such cases.

Taxes

Recent taxes

Recent income taxes, whether federal or state, are generally non-dischargeable in bankruptcy. Debts related to taxes owed within the past three years are typically not extinguished. It is essential to stay current on tax obligations and to work with the appropriate tax authorities to seek alternative payment arrangements, such as installment plans or offers in compromise.

Older taxes

While recent taxes are considered non-dischargeable, older tax debts may have different outcomes. If the taxes were assessed at least three years prior to filing for bankruptcy and certain other conditions are met, it may be possible to discharge older tax debts. However, it is crucial to consult with a tax professional or bankruptcy attorney who can help navigate the complex rules surrounding tax debt in bankruptcy.

Child Support and Alimony

Child support and alimony debts cannot be discharged through bankruptcy. These obligations are prioritized for the well-being of children and the financial support of the recipient spouse. Regardless of the bankruptcy filing, the responsibility to pay child support and alimony remains intact. Failure to meet these obligations may result in severe legal consequences, including wage garnishment, property liens, or even imprisonment.

Government Fines

Criminal fines

Bankruptcy does not eliminate fines imposed as a result of criminal convictions. If you have been fined by a court in a criminal case, those debts will remain even after bankruptcy. Criminal fines are separate from other financial obligations and cannot be discharged or reduced through the bankruptcy process. It’s important to fulfill these obligations to comply with the legal system.

Traffic citations and penalties

Debts related to traffic citations and other government-imposed penalties are generally non-dischargeable. Whether it’s a speeding ticket, parking violation, or any other fines imposed by local authorities, these debts survive bankruptcy. It is essential to address and pay these fines promptly to avoid further complications, such as driver’s license suspension or additional penalties.

Debts Incurred through Fraud or Misrepresentation

If a debt was obtained through fraud or intentional misrepresentation, it may not be dischargeable in bankruptcy. This includes debts resulting from identity theft, false loan applications, or other fraudulent activities. Bankruptcy laws operate with the intent to provide relief to honest debtors, and debts incurred through fraudulent means are not eligible for discharge. It is crucial to address such debts honestly and work towards resolving them outside of bankruptcy if possible.

Debts for Personal Injury or Death Caused by Intoxicated Driving

Debts resulting from personal injury or death caused by intoxicated driving are generally not dischargeable in bankruptcy. The courts recognize the severe and often irreversible consequences of drunk driving accidents. Therefore, any financial obligations arising from such incidents, such as compensation for medical expenses or legal settlements, remain enforceable even after bankruptcy. It is essential to prioritize the well-being and safety of others by avoiding intoxicated driving altogether.

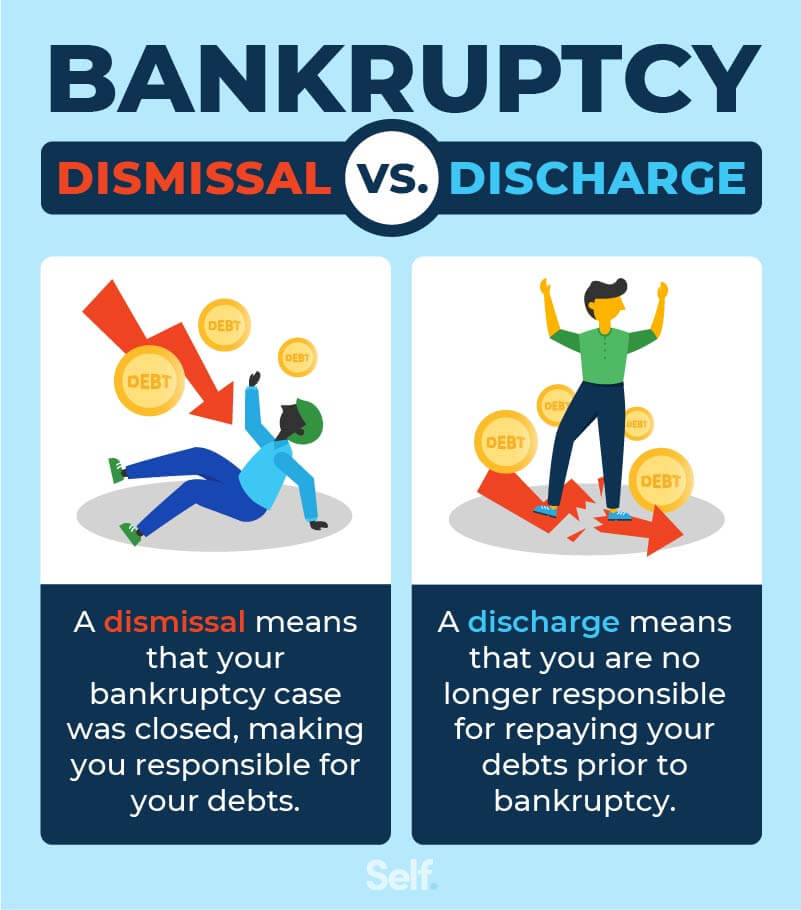

Debts Not Included in the Bankruptcy Filing

It is essential to be aware that not all debts are automatically included in a bankruptcy filing. If you have certain debts that you wish to continue paying, they can be reaffirmed. Reaffirmation is a legal process through which you and the creditor agree to exclude a particular debt from the bankruptcy discharge. By reaffirming a debt, you acknowledge your ongoing responsibility to repay it, even after the bankruptcy process is complete. It is advisable to consult with a bankruptcy attorney to understand the implications and potential benefits of reaffirmation.

Post-Bankruptcy Debts

Any debts incurred after the bankruptcy filing will not be eligible for discharge. It is crucial to understand that bankruptcy provides a fresh start for pre-existing debts but does not offer a blanket solution for future financial obligations. Responsible financial management after bankruptcy is essential to avoid falling back into overwhelming debt. Implementing a budget, building an emergency fund, and being cautious with new credit are vital steps toward securing a stable and debt-free future.

Debts Associated with Criminal Activity

Debts resulting from criminal activities, such as restitution owed to victims or court-ordered fines, cannot be discharged in bankruptcy. Bankruptcy does not provide a means to evade legal consequences or financial obligations associated with criminal behavior. It is important to address these debts responsibly and comply with any court orders or restitution requirements.

Mortgages and Secured Debts

Mortgages and other secured debts survive bankruptcy unless specific actions are taken. If you wish to keep your mortgaged property, you will need to continue making regular payments to the lender. While bankruptcy can delay foreclosure proceedings and provide an opportunity to catch up on missed payments, it does not discharge the underlying debt or automatically guarantee the retention of the property. Discussing your options with a bankruptcy attorney can help you navigate the complexities of addressing secured debts during bankruptcy.

In conclusion, bankruptcy provides relief for many types of debts, but it is essential to understand that certain obligations cannot be eliminated through this legal process. Student loans, taxes, child support, alimony, government fines, and debts resulting from fraud or misrepresentation are generally non-dischargeable. It is important to consult with a bankruptcy attorney to explore possible alternatives or strategies for managing these types of debts. Additionally, remaining responsible and proactive in financial matters after bankruptcy is crucial for a fresh start and to avoid falling back into overwhelming debt.

© 2015-2023 by burdenofdebt.com, a LIVenture. All rights reserved. No part of this document may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of LiVentures LLC.