How Much Personal Debt Is Too Much?

In this article, we will explore the important question of how much personal debt is considered too much. Whether you’re a seasoned adult or just starting out on your financial journey, understanding the limits and implications of personal debt is crucial. We will discuss key factors to consider, such as income, expenses, and long-term financial goals. By gaining insights into this topic, you can make informed decisions and achieve a healthy balance between borrowing and financial stability. So, let’s navigate the world of personal debt together and discover what constitutes a manageable level of debt.

Factors to Consider

Income and Expenses

When it comes to personal debt, one of the most important factors to consider is your income and expenses. Your income should be sufficient to cover your monthly expenses and leave room for savings. If your expenses exceed your income, it may be a sign that you are living beyond your means and relying on debt to make ends meet.

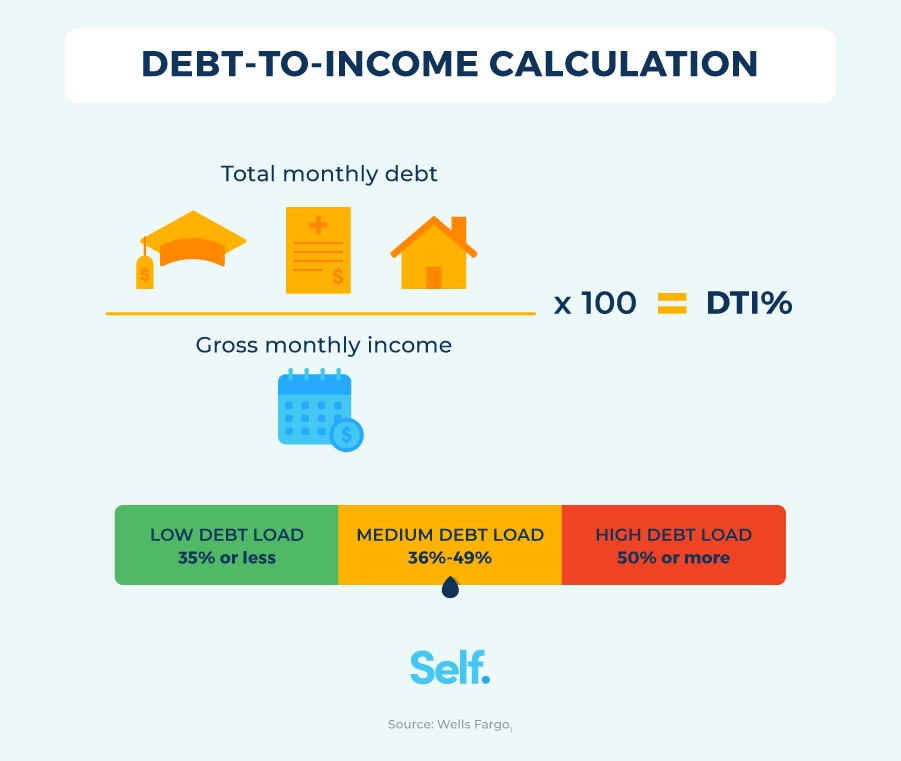

Debt-to-Income Ratio

The debt-to-income ratio is a crucial metric that lenders use to assess your ability to manage debt. It compares your monthly debt payments to your gross monthly income. A higher debt-to-income ratio indicates that a larger portion of your income is being allocated to debt repayment, which can be a cause for concern.

Savings and Emergency Fund

Having savings and an emergency fund is essential to your financial well-being. It acts as a buffer during unexpected expenses and can help prevent the need to rely on credit cards or loans to cover these costs. When assessing your debt levels, consider the impact that a lack of savings and emergency funds can have on your overall financial stability.

Financial Goals and Priorities

Everyone has different financial goals and priorities. It’s important to consider how your debt levels align with your goals. Are you prioritizing paying off high-interest debt or saving for a down payment on a house? Understanding your financial goals and priorities can help you make informed decisions about your debt and guide your repayment plan.

Understanding Debt Levels

Healthy Levels of Debt

Not all debt is bad, and there are healthy levels of debt that can work in your favor. For example, a mortgage is considered good debt as it allows you to build equity and own a home. Student loans can also be seen as an investment in your education and future earning potential. It’s important to distinguish between good and bad debt when evaluating your overall debt levels.

Warning Signs of Excessive Debt

Excessive debt can quickly become overwhelming and detrimental to your financial health. Some warning signs of excessive debt include struggling to make minimum payments, relying on credit to cover basic expenses, constantly borrowing or refinancing, receiving collection calls or notices, and neglecting other financial obligations. If you notice these warning signs, it’s important to take action and address your debt situation.

Debt-to-Asset Ratio

Another metric to consider when understanding your debt levels is the debt-to-asset ratio. This ratio compares the total amount of debt you owe to the value of your assets. It provides a snapshot of how much of your assets are financed by debt. A high debt-to-asset ratio may indicate a heavy reliance on debt to acquire assets, which can increase financial risk.

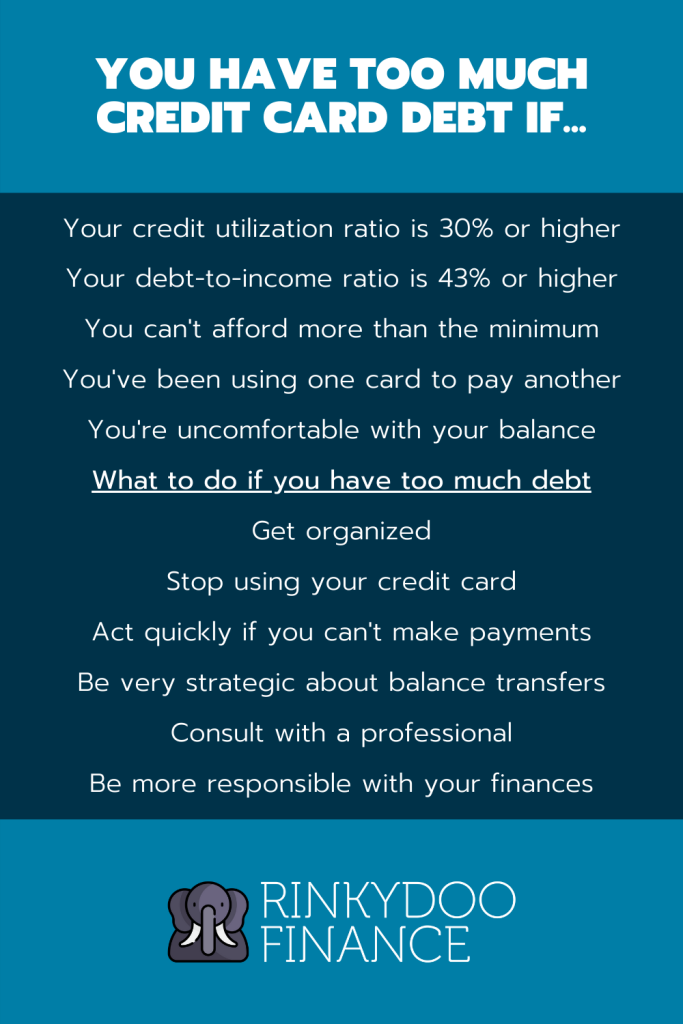

Credit Utilization Ratio

The credit utilization ratio measures the amount of credit you are using compared to your total available credit. This ratio plays a significant role in determining your credit score. A high credit utilization ratio can signal a higher risk of default and negatively impact your credit score. It’s important to keep your credit utilization ratio below 30% to maintain a healthy debt level.

Types of Debt

Good Debt vs. Bad Debt

Understanding the difference between good debt and bad debt is essential when assessing your debt levels. Good debt is considered an investment in your future, such as a mortgage or student loans. Bad debt, on the other hand, is often associated with high-interest rates and depreciating assets, such as credit card debt or auto loans. Differentiating between these types of debt can help you prioritize your repayment plan.

Mortgages and Home Loans

A mortgage or home loan is a common type of debt that allows individuals to purchase a home. It is generally considered good debt because it allows you to build equity and invest in a valuable asset. However, it’s important to carefully consider the terms and interest rates of your mortgage to ensure that it aligns with your financial goals and budget.

Student Loans

Student loans are often seen as an investment in your future earning potential. They can provide the necessary funds to obtain higher education and pursue your desired career path. However, it’s crucial to manage student loan debt responsibly and consider the impact on your overall financial well-being. Exploring repayment options and refinancing opportunities can help alleviate the burden of student loans.

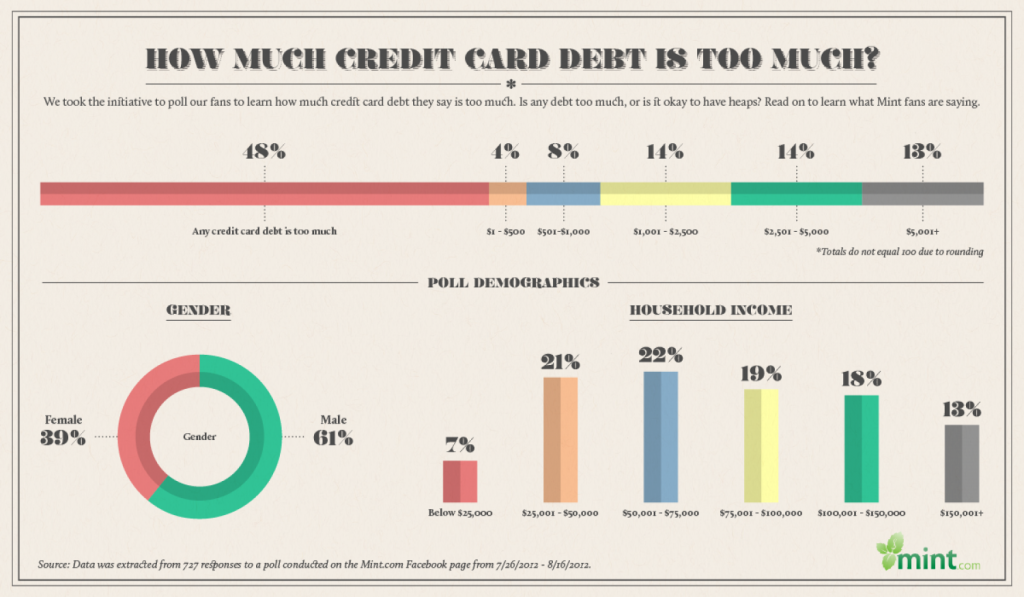

Credit Card Debt

Credit card debt is one of the most common and easily acquired forms of debt. While credit cards can be convenient, high-interest rates and minimum payments can quickly lead to overwhelming debt. It’s important to be mindful of your credit card usage and strive to pay off the full balance each month. If you find yourself struggling with credit card debt, consider debt consolidation options or seek professional help.

Auto Loans

Auto loans allow individuals to finance the purchase of a car. While having reliable transportation is important, it’s essential to consider the long-term financial implications of an auto loan. The depreciating value of a vehicle coupled with interest payments can lead to negative equity and excessive debt. Evaluating your budget and exploring alternatives such as purchasing a used vehicle or saving for a down payment can help minimize the impact of auto loans on your overall debt.

Personal Loans

Personal loans are unsecured loans that can be used for various purposes, such as debt consolidation, home improvements, or unexpected expenses. While personal loans can provide temporary financial relief, it’s important to carefully consider the terms and interest rates before taking on additional debt. Proper budgeting and prioritization of payments can help manage personal loan debt effectively.

Assessing the Impact of Debt

Effects on Credit Score

One of the major impacts of debt is on your credit score. Late payments, high credit utilization, and defaulting on loans can all have a negative effect on your credit score. A lower credit score can make it more difficult to secure future loans, obtain favorable interest rates, or even rent an apartment. It’s crucial to manage your debt responsibly to maintain a good credit score.

Ability to Save and Invest

High levels of debt can hinder your ability to save and invest for the future. When a significant portion of your income is allocated towards debt repayment, it leaves less room for savings and investments. Building an emergency fund, saving for retirement, or funding other long-term goals may become challenging. It’s important to strike a balance between debt repayment and saving for your future financial security.

Stress and Mental Health

Debt can have a significant impact on your mental health and overall well-being. Constantly worrying about making payments, managing multiple creditors, and feeling overwhelmed by debt can contribute to high levels of stress and anxiety. It’s important to prioritize your mental health and seek support if you’re experiencing emotional distress related to your debt.

Relationships and Family

Financial difficulties and excessive debt can strain relationships and put a strain on family dynamics. Arguments about money, disagreements over spending habits, and the inability to contribute to joint goals can lead to relationship breakdowns. It’s important to communicate openly with your loved ones about your debt situation and work together to find solutions that are beneficial for everyone involved.

Debt-to-Income Ratio Guidelines

Ideal Debt-to-Income Ratio

The ideal debt-to-income ratio is typically considered to be below 36%. This means that no more than 36% of your gross monthly income should be allocated towards debt repayment. A lower debt-to-income ratio indicates that you have more disposable income available for savings and other financial goals.

Acceptable Debt-to-Income Ratio

An acceptable debt-to-income ratio may vary depending on individual circumstances and financial goals. Generally, a ratio below 43% is considered acceptable and indicates that you have a manageable level of debt. However, it’s important to consider your overall financial situation and prioritize reducing your debt levels whenever possible.

Risks of High Debt-to-Income Ratio

Having a high debt-to-income ratio can put you at a higher risk of financial instability. If a significant portion of your income goes towards debt repayment, it leaves little room for unexpected expenses or savings. A high debt-to-income ratio can also make it more challenging to qualify for future loans or secure favorable interest rates. Minimizing your debt-to-income ratio is crucial for achieving long-term financial stability.

Signs of Overwhelming Debt

Struggling to Make Minimum Payments

If you find yourself consistently struggling to make the minimum payments on your debts, it may be a sign that your debt levels are becoming overwhelming. This can lead to late payment fees, increased interest charges, and further financial stress. Ignoring the problem and failing to address it promptly can exacerbate the situation.

Using Credit to Cover Basic Expenses

Using credit cards or loans to cover basic living expenses, such as groceries or utility bills, is a clear indication that your debt levels are becoming unmanageable. Relying on credit to meet essential expenses is a sign that your income is not sufficient to cover your day-to-day needs. It’s crucial to reassess your budget and find ways to reduce your reliance on debt for basic living expenses.

Constantly Borrowing or Refinancing

If you constantly find yourself borrowing money or refinancing existing loans to pay off other debts, it’s a clear sign that your debt levels are spiraling out of control. This cycle of borrowing to repay debts only adds to the overall amount owed and increases the interest charges. Seeking professional help or exploring debt consolidation options may be necessary to break this cycle.

Receiving Collection Calls or Notices

Receiving collection calls or notices from creditors is a strong indication that your debts are in arrears and have not been paid as agreed. This can have serious consequences on your credit score and overall financial stability. It’s important to address these collection efforts promptly and determine the best course of action to resolve your debts.

Neglecting Other Financial Obligations

When your debt levels are overwhelming, it’s common to neglect other financial obligations such as utility bills, rent or mortgage payments, or insurance premiums. This can have severe consequences, including eviction, utility disconnection, or lapse in insurance coverage. It’s crucial to prioritize your financial obligations and seek assistance if you are struggling to meet them.

Establishing a Debt Repayment Plan

Budgeting and Prioritizing Payments

Creating a realistic budget is the first step toward establishing a debt repayment plan. Evaluate your income, expenses, and debt obligations to determine how much you can allocate towards debt repayment each month. Prioritize your higher-interest debts or those with the smallest balances to create a strategy that works best for you.

Debt Consolidation Options

Debt consolidation involves combining multiple debts into a single loan or credit card with a lower interest rate. This can make it easier to manage your debt and potentially reduce your monthly payments. However, it’s important to carefully consider the terms and fees associated with debt consolidation and ensure that it aligns with your financial goals.

Negotiating with Creditors

If you’re struggling to make your debt payments, it may be worth reaching out to your creditors to discuss potential options. They may be willing to work with you to modify your repayment terms, reduce interest rates, or offer alternative payment arrangements. Open and honest communication with your creditors can lead to more manageable debt repayment options.

Seeking Professional Financial Help

If your debt levels are overwhelming and you’re unsure how to proceed, seeking professional financial help may be necessary. Financial advisors, consumer credit counseling agencies, and bankruptcy attorneys can provide guidance and support in navigating your debt situation. They can help you explore various strategies and determine the best course of action based on your individual circumstances.

Avoiding Excessive Debt

Living within Means

One of the best ways to avoid excessive debt is to live within your means. This means spending less than you earn and being mindful of your budget. Avoid the temptation to overspend or rely on credit to finance a lifestyle that you cannot afford in the long run. Prioritize your needs over wants and make conscious choices when it comes to spending.

Avoiding Impulsive Purchases

Impulse buying can quickly lead to excessive debt. Before making a purchase, take the time to evaluate whether it is a want or a need. Consider if the item is within your budget and if it aligns with your financial goals. Practicing mindful spending and avoiding impulsive purchases can help you keep your debt levels in check.

Building and Maintaining an Emergency Fund

Having an emergency fund is crucial to avoid relying on credit cards or loans during unexpected situations. Aim to save at least three to six months’ worth of living expenses in an easily accessible account. This fund can provide a safety net and help prevent the accumulation of excessive debt when faced with a sudden job loss or medical emergency.

Regularly Reviewing and Adjusting Budget

Financial circumstances can change over time, so it’s important to regularly review and adjust your budget accordingly. Reassess your income, expenses, and debt obligations periodically to ensure that your budget is aligned with your current financial situation and goals. Making necessary adjustments can help you stay on track and avoid unnecessary debt.

Improving Financial Literacy

Improving your financial literacy is essential to make informed decisions about your debt and overall financial well-being. Educate yourself on topics such as budgeting, credit management, and debt repayment strategies. There are numerous resources available online, including personal finance books, podcasts, and websites, that can help you enhance your financial literacy.

Balancing Debt with Financial Goals

Saving for Retirement

While it may be tempting to focus solely on debt repayment, it’s important not to neglect saving for retirement. Start contributing to a retirement account as early as possible to take advantage of compounding interest and maximize your long-term savings. By striking a balance between debt repayment and retirement savings, you can work towards a secure financial future.

Investing in Assets

Investing in assets, such as real estate or stocks, can provide an opportunity for wealth accumulation and diversification. However, it’s crucial to carefully evaluate your debt levels and financial situation before venturing into investments. Seek professional advice and conduct thorough research to ensure that your investment decisions align with your risk tolerance and financial goals.

Funding Education

If funding education is one of your financial goals, it’s important to approach it strategically to avoid excessive debt. Consider alternative options such as scholarships, grants, or part-time work while studying. If taking out student loans is necessary, explore repayment options and strive to minimize the overall debt burden. Education is an investment, but it’s crucial to approach it with careful consideration.

Planning for Major Life Events

Life events such as getting married, starting a family, or purchasing a home often come with significant financial implications. It’s important to plan ahead and account for these expenses to avoid excessive debt. Saving in advance, creating a budget, and exploring financing options can help ensure that these major life events are financially manageable and don’t lead to overwhelming debt.

Seeking Professional Advice

Financial Advisor

A financial advisor can provide expert guidance and help you navigate your debt and overall financial situation. They can assess your individual circumstances, evaluate your goals, and develop a personalized plan to address your debt while working towards your financial objectives. A financial advisor can also provide ongoing support and help you stay on track toward a healthier financial future.

Consumer Credit Counseling

Consumer credit counseling agencies offer professional assistance and resources to help individuals manage their debt. They can provide advice on budgeting, debt management plans, and negotiating with creditors. Credit counseling agencies often work on a nonprofit basis and can offer valuable insights and support for those struggling with debt.

Bankruptcy Attorney

While bankruptcy should be considered a last resort, it may be the best option for some individuals facing overwhelming debt. Bankruptcy attorneys specialize in guiding individuals through the legal process of filing for bankruptcy and can provide expert advice on navigating this complex area of law. If you’re considering bankruptcy, it’s crucial to consult with a qualified attorney to understand the implications and potential outcomes.

In conclusion, understanding your debt levels and taking proactive steps to address them is crucial for your financial well-being. By considering various factors such as income, debt-to-income ratio, and savings, you can assess your debt situation and make informed decisions. Evaluating different types of debt, such as mortgages, student loans, and credit card debt, can help prioritize your repayment plan. It’s important to be aware of the impact of debt on your credit score, ability to save and invest, and overall mental health. By following debt-to-income ratio guidelines, recognizing signs of overwhelming debt, and establishing a debt repayment plan, you can regain control of your finances. It’s also essential to avoid excessive debt by living within your means, prioritizing financial goals, and seeking professional advice when necessary. Balancing debt with long-term objectives and considering professional assistance from financial advisors, credit counseling agencies, or bankruptcy attorneys can provide additional support in managing your debt effectively. By taking these steps, you can work towards a healthier financial future and minimize the negative impact of personal debt.

© 2015-2023 by burdenofdebt.com, a LIVenture. All rights reserved. No part of this document may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of LiVentures LLC.