Can Debt Collectors Call Your Family?

In the world of debt collection, there is a concern that often weighs heavy on people’s minds: Can debt collectors call your family? This article aims to shed light on this topic and provide you with the information you need to understand your rights and protect your loved ones. Whether you have been contacted by a debt collector or are simply curious about how they operate, read on to gain valuable insights into this often misunderstood aspect of debt collection.

Debt Collection Basics

Definition of debt collection

Debt collection refers to the process of pursuing payment from individuals who owe money to creditors or debt collection agencies. This can include various types of debt, such as credit card bills, medical bills, student loans, and more. When a debtor fails to make payments on time, the creditor may enlist the services of a debt collector to retrieve the outstanding amount.

The role of debt collectors

Debt collectors play a significant role in the debt collection process. They are hired by creditors or debt collection agencies to contact debtors and attempt to collect the owed funds. Debt collectors may work independently or as part of a larger agency. Their primary responsibility is to communicate with debtors and negotiate payment arrangements in order to recover the outstanding debt.

Rights and protections for debtors

While debt collectors have the responsibility of pursuing payment, it is important for debtors to be aware of their rights and protections. The Fair Debt Collection Practices Act (FDCPA) is a federal law that prohibits abusive and deceptive practices by debt collectors. Under this law, debtors have the right to be treated with respect and fairness. They also have the right to dispute the debt, request verification of the debt, and be free from harassment.

Understanding Debt Collection Practices

Telephone Consumer Protection Act (TCPA)

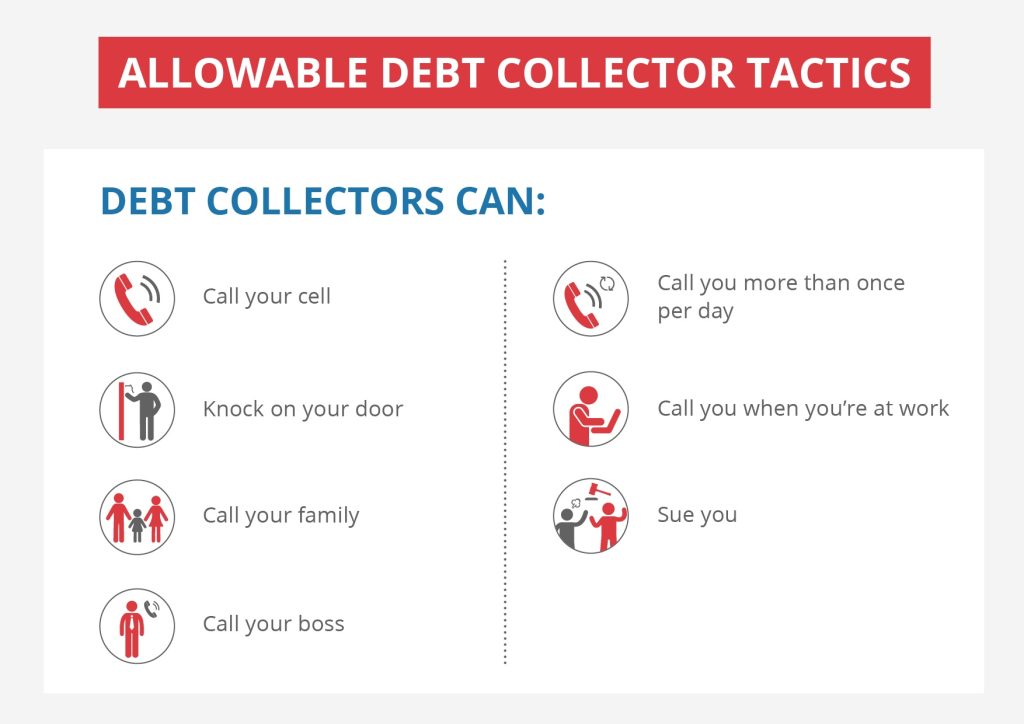

The Telephone Consumer Protection Act (TCPA) is a federal law that governs the practices of debt collectors when communicating with debtors via telephone. It sets certain restrictions on the use of automated dialing systems, prerecorded messages, and unsolicited text messages. Debt collectors must obtain the debtor’s consent before contacting them using these methods, and they are not allowed to call repeatedly, especially if the debtor has requested them to stop.

Fair Debt Collection Practices Act (FDCPA)

The Fair Debt Collection Practices Act (FDCPA) is a crucial piece of legislation that provides guidelines and protections for debtors. It prohibits debt collectors from engaging in unfair, deceptive, or abusive practices in their attempts to collect debts. For example, debt collectors cannot use false pretenses, threaten violence, or use offensive language when communicating with debtors. They are also prohibited from misrepresenting the amount owed or making false statements.

Harassment and abusive behavior

Harassment and abusive behavior from debt collectors are strictly forbidden. It is important for debtors to know that they have the right to be treated with respect and courteousness. Debt collectors should not engage in practices such as making excessive or annoying phone calls, using profanity, or threatening legal action that they cannot legally take. If debtors experience harassment or abusive behavior, they can report the debt collector to the Federal Trade Commission (FTC) and their state’s Attorney General’s office.

Prohibited contact times

Debt collectors are bound by certain rules regarding when they can contact debtors. They are generally restricted from contacting debtors before 8 a.m. or after 9 p.m. in the debtor’s local time zone unless the debtor provided consent for such contact outside these hours. Additionally, if a debt collector knows that the debtor is represented by an attorney, they are prohibited from contacting the debtor directly and must communicate solely with the attorney.

Who Can Debt Collectors Contact?

Debtor’s contact information

Debt collectors have the right to contact debtors to pursue payment. They often start by reaching out to the debtor using the contact information provided to the creditor or through public records. This includes contacting debtors by phone, mail, or electronic means. However, debt collectors must respect the rights and protections outlined by the FDCPA, such as not contacting the debtor at inconvenient times or places.

Place of employment

Debt collectors may contact debtors at their place of employment unless they are specifically informed that such calls are prohibited by the employer. While this may seem concerning for debtors, it is worth noting that debt collectors should use professional discretion when contacting debtors at work and should not disclose the purpose of the call to anyone other than the debtor.

Attorney representation

If a debtor is represented by an attorney regarding the debt in question, debt collectors must direct all communications with the attorney instead of contacting the debtor directly. This is to ensure that debtors receive appropriate legal advice and are not subjected to undue pressure from debt collectors. It is important for debtors to inform debt collectors immediately when they have legal representation.

Spouses and joint accounts

In cases where the debt is from a joint account or the debtor is married and resides in a community property state, debt collectors may contact the debtor’s spouse regarding the debt. However, they should exercise caution and refrain from discussing the details of the debt with the spouse unless the spouse is also responsible for the debt. Debt collectors should also respect the debtor’s privacy and avoid discussing the debt with third parties who are not liable for the debt.

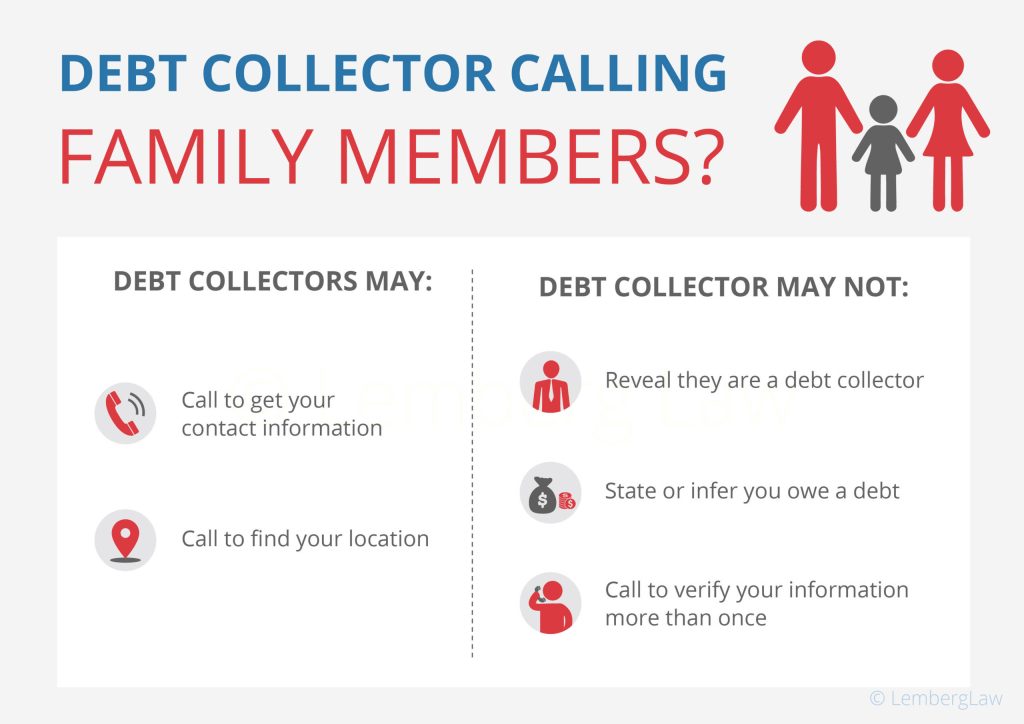

Other authorized third parties

Debt collectors may only contact other authorized third parties, such as relatives, friends, or neighbors, to locate or obtain the debtor’s contact information. However, they are prohibited from discussing the debt unless it is to confirm or correct the debtor’s location information. Debt collectors must handle these conversations with discretion and avoid disclosing any sensitive debt-related details to third parties.

When Can Debt Collectors Call Your Family?

Attempts to locate debtors

In some cases, debt collectors may find it necessary to contact family members in order to locate a debtor who cannot be reached directly. This is typically done when the debt collector has exhausted other means of locating the debtor or if the debtor has provided consent for such contact. Debt collectors may ask family members for the debtor’s current address, phone number, or any other relevant contact information that can help in pursuing the debt.

Contacting family members

When contacting family members, debt collectors must maintain a professional and respectful approach. They should clearly identify themselves as debt collectors and explain their purpose for contacting the family member. However, they are prohibited from disclosing the nature of the debt unless the family member is also responsible for the debt. Debt collectors should seek to gather information and avoid engaging in conversations that could potentially harm the debtor’s personal relationships.

Limits on disclosure of debt details

Debt collectors are obligated to respect the privacy of the debtor and are generally not allowed to disclose the details of the debt to family members or any other third parties unless they are jointly responsible for the debt. Debt collectors should only disclose information necessary to locate the debtor or provide sufficient information for the recipient to contact the debt collector to discuss the debt further.

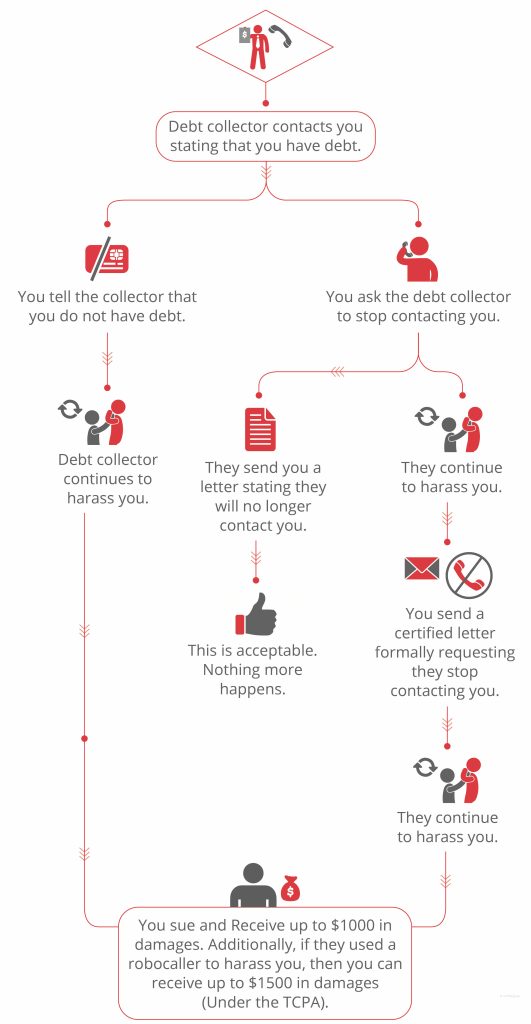

Exceptions to contacting family

While debt collectors are generally allowed to contact family members to locate debtors, there are certain exceptions to this rule. If the debtor has requested in writing that the debt collector not contact their family, the debt collector must comply with this request. Additionally, if the debt collector knows or should know that the debtor is represented by an attorney, they should refrain from contacting family members and direct all communication through the attorney.

The Importance of Written Communication

Dealing with debt collectors in writing

Written communication can be a valuable tool when dealing with debt collectors. It allows debtors to maintain a record of all interactions, ensuring that there is a clear and documented trail of communication. When corresponding with debt collectors, it is important to be concise, clear, and polite. Clearly state your concerns and requests, and keep copies of all correspondence for future reference.

Certified mail and proof of delivery

When sending written correspondence to debt collectors, it is recommended to use certified mail with the return receipt requested. This provides proof of mailing and a record of delivery, ensuring that debtors have evidence that the letter was received by the intended recipient. This can be crucial in cases where disputes arise or if debt collectors claim not to have received certain correspondence.

Keeping records of correspondence

It is essential for debtors to maintain a detailed record of all communications with debt collectors. This includes not only written correspondence but also records of phone calls, including the date, time, and a brief summary of the conversation. These records will serve as evidence in case any issues or disputes arise, and they can help protect debtors’ rights if unfair or abusive practices occur.

Potential Consequences and Legal Actions

Negative impact on personal relationships

Dealing with debt collectors and financial difficulties can be highly stressful and can put a strain on personal relationships. The constant contact with debt collectors and the anxiety caused by the debt can lead to increased stress, arguments, and even the breakdown of relationships. It is important for debtors to communicate openly with their loved ones, seek support, and work together to find solutions to the debt issue.

Credit reporting agencies and credit scores

Unresolved debts and negative interactions with debt collectors can have long-lasting consequences on credit scores and credit reports. When debts go into collections and remain unpaid, this information can be reported to credit reporting agencies, resulting in a negative impact on the debtor’s creditworthiness. This, in turn, can affect the debtor’s ability to obtain loans, secure housing, or receive favorable interest rates in the future.

Possible legal actions against debt collectors

If debt collectors engage in unfair or deceptive practices, debtors have the right to take legal action against them. The FDCPA provides provisions for debtors to pursue legal remedies in cases of violations. Debt collectors who violate the FDCPA may be sued for damages, including actual damages, statutory damages, and attorney’s fees. It is important for debtors to keep records of any violations and consult with legal professionals if necessary.

Resolving issues with legal assistance

In cases where debtors encounter persistent harassment, abusive behavior, or violations of their rights by debt collectors, seeking legal assistance may be necessary. Lawyers experienced in debt collection laws can provide guidance, review the debtor’s case, and help determine the best course of action. Legal professionals can also negotiate with debt collectors on behalf of the debtor to reach a fair resolution or assist in pursuing legal action if needed.

Strategies for Dealing with Debt Collectors

Know your rights and protections

The first step in dealing with debt collectors is to understand your rights and protections as a debtor. Familiarize yourself with the FDCPA and other relevant laws and regulations. Knowing what debt collectors are and aren’t allowed to do can help you assert your rights, protect yourself from abuse, and negotiate effectively.

Validate the debt

If you’re unsure about the legitimacy of a debt or if you believe there may be errors, it is important to request validation of the debt. This involves sending a written request to the debt collector asking for proof that the debt is legitimate and that they have the right to collect it. Debt collectors must provide this validation within a certain timeframe and cease collection activities until they have done so.

Negotiating payment plans

In many cases, debtors may be unable to pay the full amount owed in a lump sum. Debt collectors are often willing to work with debtors to establish a payment plan that is more manageable. Before making any agreements, carefully review your financial situation and determine what you can reasonably afford to pay. Be open and honest with the debt collector and attempt to negotiate a payment plan that suits both parties.

Seeking professional advice

If you find yourself overwhelmed by debt or struggling to resolve issues with debt collectors, seeking professional advice can be beneficial. Credit counseling agencies and financial advisors specialize in helping individuals navigate their debt and can provide guidance on budgeting, debt management strategies, and negotiating with debt collectors. Their expertise can offer valuable insights and help you make informed decisions.

Filing complaints if necessary

If debt collectors engage in unfair or abusive practices, it is important to report these actions to the appropriate authorities. Start by filing a complaint with the debt collector’s company to notify them of the issue. If the misconduct persists, consider filing a complaint with the FTC, the Consumer Financial Protection Bureau (CFPB), and your state’s Attorney General’s office. These organizations can investigate the matter and take appropriate action against the debt collector.

Protecting Your Family’s Privacy

Educating family members

One of the key ways to protect your family’s privacy when dealing with debt collectors is to educate your family members about the situation. Inform them about your rights, the protections in place, and what to do if they are contacted by a debt collector. By proactively sharing information, you can empower your family to respond appropriately and avoid sharing unnecessary information with debt collectors.

Protective measures for personal information

Protecting your personal information is vital in preventing unnecessary contact with debt collectors. Be cautious about who you share your contact information with and take steps to safeguard it. Avoid posting personal information on social media platforms or other public forums. If you believe your personal information has been compromised, consider alerting credit reporting agencies and placing a fraud alert or security freeze on your credit reports.

Avoiding unnecessary disclosures

When communicating with debt collectors, it is important to avoid disclosing unnecessary information about yourself or your family. Debt collectors may try to extract personal details or use emotionally charged tactics to pressure you into making payments. Stay focused on discussing the debt itself and the necessary steps to resolve it. Remember that you have the right to decline to answer personal questions that are not relevant to the debt.

When to Seek Legal Help

Determining if legal assistance is necessary

While many debt-related issues can be resolved through communication and negotiation, there may be situations where seeking legal help is necessary. If you believe your rights have been violated, you’ve been subjected to harassment, or you’re facing legal actions from debt collectors, consulting with an attorney who specializes in debt collection practices can provide you with the guidance you need. They can assess your case, inform you of your legal options, and represent you if the situation escalates.

Finding appropriate legal representation

Finding the right legal representation to assist with debt collection issues is crucial. Look for attorneys who specialize in consumer protection laws or debt collection defense. Seek recommendations from trusted sources, such as friends, family, or professionals, or utilize online directories to find attorneys with experience in the specific area of debt collection. Schedule initial consultations to discuss your case and determine if the attorney is the right fit for you.

Conclusion

Understanding your rights as a debtor is essential when navigating the debt collection process. Debt collectors play a significant role in pursuing owed funds, but they must adhere to laws and regulations that protect debtors from abusive or unfair practices. By knowing your rights, maintaining clear records, and seeking legal help when necessary, you can protect both yourself and your family throughout the debt collection journey. Remember to stay informed, communicate openly, and pursue resolution strategies that work best for your financial situation.

© 2015-2023 by burdenofdebt.com, a LIVenture. All rights reserved. No part of this document may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of LiVentures LLC.