How The Debt To Income Ratio Is Calculated?

In this article, you will discover the ins and outs of calculating your debt-to-income ratio. For those seeking to gain a deeper understanding of debt, this information will prove invaluable. By examining the various factors that contribute to this ratio, you will be equipped with the knowledge to assess your financial standing and make informed decisions. Let’s explore the method behind calculating the debt-to-income ratio, empowering you to take control of your financial future.

What is Debt to Income Ratio?

Definition

Debt to Income Ratio, also known as DTI Ratio, is a financial metric that measures the proportion of an individual’s monthly debt payments to their monthly income. It is used by lenders and financial institutions to assess the borrower’s ability to manage their debt and make timely repayments.

Importance

Debt to Income Ratio is an important indicator of a person’s financial health and stability. It provides valuable insights into their ability to handle additional debt obligations and make timely payments. Lenders use this ratio to determine loan eligibility and assess the risk of lending money to an individual. Understanding and managing your DTI Ratio can have a significant impact on your financial well-being and future borrowing opportunities.

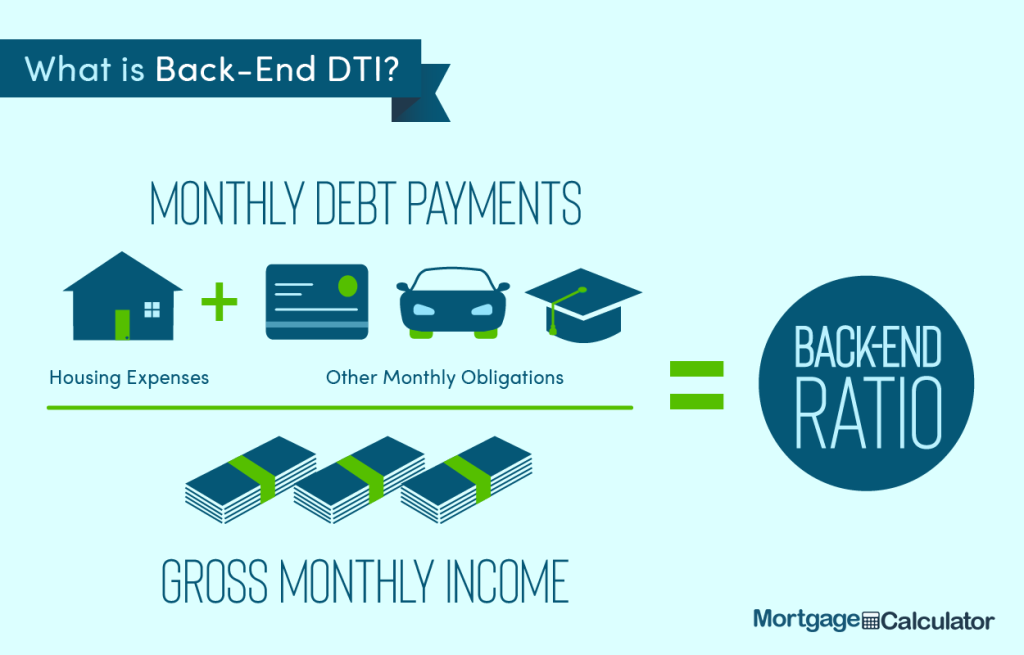

Components of Debt to Income Ratio

Debt

The first component of the Debt to Income Ratio is the total debt. This includes all the monthly debt payments you are obligated to make, such as mortgage payments, car loan payments, student loan payments, credit card payments, and any other outstanding loans.

Income

The second component of Debt to Income Ratio is the total income. This includes all the money you earn on a monthly basis, including salary, wages, bonuses, commissions, rental income, and any other sources of income.

Calculating Debt to Income Ratio

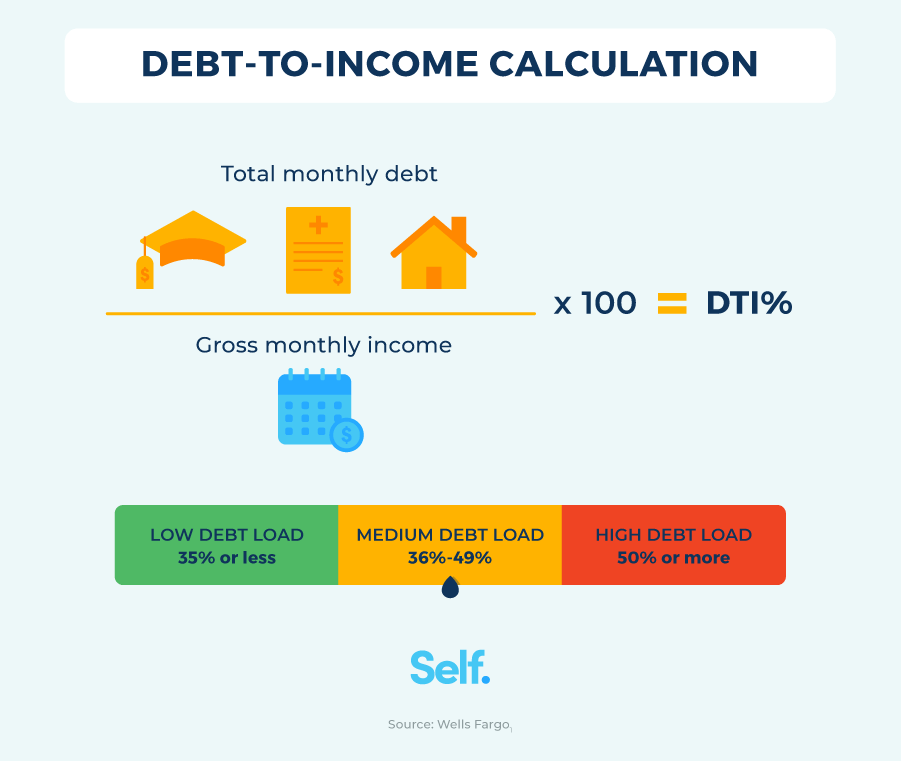

Step 1: Determine Monthly Debt Payments

To calculate your Debt to Income Ratio, start by determining your total monthly debt payments. Add up all your monthly debt obligations, including mortgage, car loans, student loans, credit card debt, and other outstanding loans.

Step 2: Calculate Monthly Income

Next, calculate your total monthly income. This includes your salary, wages, bonuses, commissions, rental income, and any other sources of regular income.

Step 3: Divide Debt by Income

Once you have determined your total monthly debt payments and total monthly income, divide the total debt by the total income. Multiply the result by 100 to get the Debt to Income Ratio percentage.

Analyzing Debt to Income Ratio

Interpretation of Ratios

Debt to Income Ratio can be interpreted in different ways depending on the specific situation. A lower DTI Ratio indicates that a smaller portion of your income is being used to pay off debts, which is generally considered favorable. On the other hand, a higher DTI Ratio suggests that a larger portion of your income is allocated towards debt payments, which may be a cause for concern for lenders.

Recommended Thresholds

While the ideal DTI Ratio varies among lenders and loan types, there are generally accepted thresholds to evaluate an individual’s financial health. A DTI Ratio below 36% is typically considered good, as it indicates a manageable level of debt in relation to income. A DTI Ratio between 36% and 49% may be viewed as moderate, while a DTI Ratio above 50% is generally seen as high and may signal a higher risk of financial difficulty.

Factors Affecting Debt to Income Ratio

Lenders’ Criteria

Different lenders may have varying criteria when evaluating Debt to Income Ratio. Some may be more flexible and willing to lend to individuals with higher DTI Ratios, while others may have stricter requirements. Understanding the lenders’ specific criteria is important to determine your loan eligibility.

Financial Health

Debt to Income Ratio reflects your overall financial health and stability. If you have a low DTI Ratio, it indicates that you have more financial flexibility and are better able to manage your debt. Conversely, a high DTI Ratio may signify financial strain and suggest that you may struggle to make repayments.

Credit Score

Your credit score plays a significant role in determining your DTI Ratio. A higher credit score typically results in lower interest rates and better loan terms, which can help improve your DTI Ratio. On the other hand, a lower credit score may result in higher interest rates and stricter loan terms, which can negatively impact your DTI Ratio.

Advantages of a Low Debt to Income Ratio

Improved Financial Stability

Having a low Debt to Income Ratio indicates that you have a healthier balance between your debt obligations and income. It suggests that you have more disposable income available to cover your daily expenses, save for the future, and handle unexpected financial challenges. This improved financial stability can provide peace of mind and reduce stress related to financial burdens.

Increased Borrowing Capacity

A low Debt to Income Ratio increases your borrowing capacity and improves your chances of securing loans at favorable terms. Lenders are more likely to view you as a low-risk borrower and may offer you lower interest rates, higher loan amounts, and more flexible repayment options. This can be especially beneficial when seeking major loans such as a mortgage or a business loan.

Disadvantages of a High Debt to Income Ratio

Financial Instability

A high Debt to Income Ratio can result in financial instability and increased stress. If a significant portion of your income is already allocated towards debt payments, it leaves less room for unexpected expenses or emergencies. This can put you at greater risk of falling behind on payments, incurring late fees, damaging your credit score, and potentially facing collections actions.

Limited Borrowing Opportunities

A high Debt to Income Ratio can also limit your borrowing opportunities. Lenders may perceive you as a higher-risk borrower and be less willing to extend credit to you. If you are already heavily burdened by debt, it may be difficult to qualify for new loans or lines of credit. This can hinder your ability to make important investments or pursue opportunities that require additional financing.

Strategies to Improve Debt to Income Ratio

Increase Income

One effective strategy to improve your Debt to Income Ratio is to increase your income. This can be achieved by asking for a raise at work, taking on additional overtime or part-time hours, finding a higher-paying job, or exploring alternative sources of income such as freelancing or starting a side business. Increasing your income allows you to allocate more funds toward debt repayment and reduce your DTI Ratio.

Reduce Debt

Another strategy to improve your Debt to Income Ratio is to reduce your debt. Start by creating a budget and tracking your expenses to identify areas where you can cut back on spending. Consider consolidating high-interest debt into a lower-interest loan, paying off smaller debts first, negotiating with creditors for lower interest rates or repayment plans, and prioritizing debt repayment over unnecessary expenses. By reducing your debt, you can lower your monthly payments and improve your overall DTI Ratio.

Importance of Debt to Income Ratio in Personal Finance

Determining Loan Eligibility

Debt to Income Ratio is a crucial factor that lenders consider when determining loan eligibility. It helps lenders assess the risk of lending money to an individual and their ability to repay the loan based on their current level of debt and income. By maintaining a healthy DTI Ratio, you increase your chances of qualifying for loans and securing favorable loan terms.

Managing Debt Responsibly

Understanding and monitoring your Debt to Income Ratio is an important aspect of managing your debt responsibly. By keeping your DTI Ratio within acceptable limits, you ensure that you can meet your financial obligations, avoid excessive debt, and maintain a strong financial foundation. Regularly reviewing and adjusting your DTI Ratio assists in making informed financial decisions and staying in control of your debt.

Conclusion

Debt to Income Ratio is a critical metric used to assess an individual’s financial health and stability. By understanding how to calculate and analyze your DTI Ratio, you can gain valuable insights into your financial situation and make informed decisions regarding your borrowing capacity. Maintaining a low DTI Ratio through strategies such as increasing income and reducing debt can improve your financial stability, expand your borrowing opportunities, and ensure responsible debt management. Keep in mind that lenders’ criteria, your financial health, and your credit score can all impact your DTI Ratio, so it is essential to prioritize responsible financial management for a secure financial future.

© 2015-2023 by burdenofdebt.com, a LIVenture. All rights reserved. No part of this document may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of LiVentures LLC.