Smart Strategies For Negotiating Debt Settlements

If you are struggling with debt and looking for effective ways to negotiate settlements, this article is for you. Packed with smart strategies and practical tips, it aims to empower individuals in debt and assist them in taking control of their financial situation. Whether you are dealing with credit card debt, medical bills, or loans, these strategies can help you navigate the complex world of debt negotiations with confidence and ease. Get ready to transform your financial future through smart negotiation tactics.

Understand Your Debt and Financial Situation

Analyze Your Debts

The first step in negotiating a debt settlement is to have a thorough understanding of your debt. Make a list of all the debts you owe, including credit cards, personal loans, medical bills, and any other outstanding balances. Take note of the total amount you owe for each debt, the interest rates, and the minimum monthly payment required.

Assess Your Income and Expenses

Next, it’s crucial to assess your income and expenses. Calculate your monthly income by adding up all your sources of income, such as your salary, side hustle earnings, or rental income. Then, analyze your monthly expenses, including rent or mortgage payments, utilities, groceries, transportation, and any other regular bills.

By identifying your income and expenses, you can determine how much money you have available each month to put toward paying off your debts.

Determine Your Debt-to-Income Ratio

Calculating your debt-to-income ratio is essential to understanding your financial standing. To do this, divide your total monthly debt payments by your gross monthly income (before taxes). Multiply the result by 100 to get the percentage.

Ideally, your debt-to-income ratio should be below 43%. If it’s higher, it indicates that a significant portion of your income is going towards debt repayment, which may make it challenging to negotiate a settlement. However, don’t worry if your ratio is high initially, as the strategies discussed in this article will help you improve it.

Evaluate Your Credit Score

Knowing your credit score is crucial when negotiating a debt settlement. Your credit score reflects your creditworthiness and impacts your ability to borrow money in the future. You can obtain your credit score from credit reporting agencies such as Equifax, Experian, or TransUnion.

A higher credit score gives you more leverage in negotiating favorable settlement terms. If your credit score is low, don’t be discouraged. There are still strategies you can utilize to improve your financial situation and negotiate a settlement successfully.

Educate Yourself on Debt Settlement

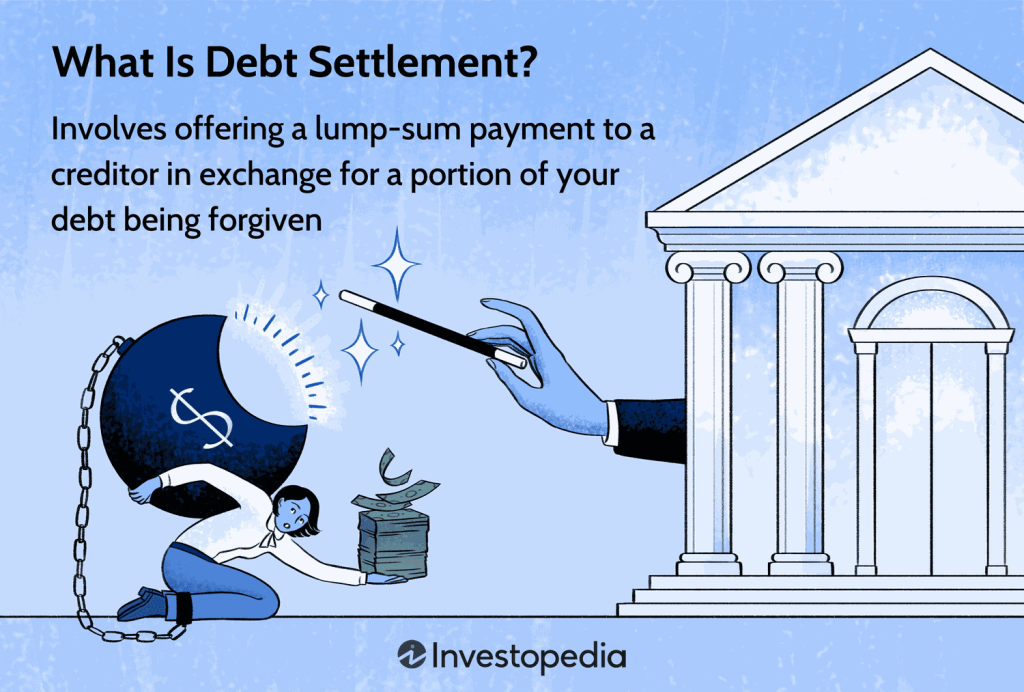

Learn About Debt Settlement Options

Before diving into the negotiation process, it’s essential to familiarize yourself with debt settlement options. Debt settlement is a negotiation between you and your creditors to settle your debts for less than the total amount owed. This can provide you with a more manageable and affordable way to become debt-free.

There are different debt settlement options available, including working with debt settlement companies or engaging in self-negotiation. Take the time to research these options and understand their pros and cons.

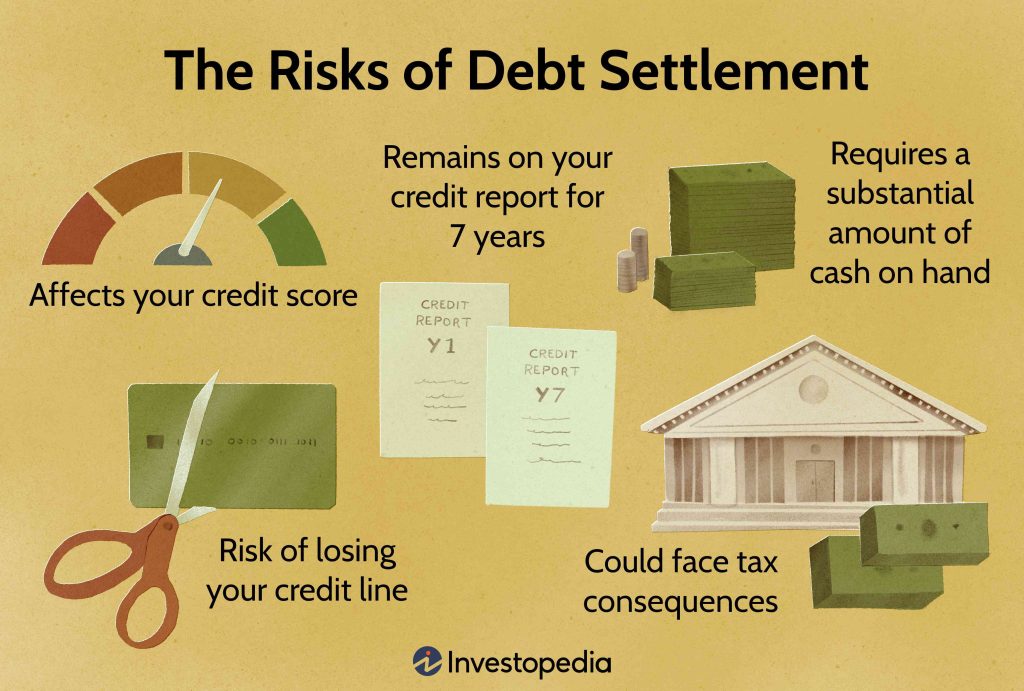

Understand the Pros and Cons

While debt settlement can be an effective strategy for debt relief, it’s crucial to understand the advantages and disadvantages. The key benefit of debt settlement is the potential to reduce your overall debt amount, making it more feasible to pay off. Additionally, settling your debts can help you avoid bankruptcy and its implications.

However, it’s important to recognize some potential drawbacks, such as the impact on your credit score. Debt settlement may lead to a temporary decrease in your credit score, but with diligent effort, you can rebuild your credit over time.

Research Debt Settlement Companies

If you decide to work with a debt settlement company, thorough research is essential. Look for companies with good reputations and positive reviews from clients. Verify their credentials and check if they are accredited by reputable organizations like the American Fair Credit Council (AFCC) or the International Association of Professional Debt Arbitrators (IAPDA).

Transparency is crucial when working with a debt settlement company. Ensure they provide clear information on fees, timelines, and potential outcomes before making any commitments.

Find Reputable Debt Settlement Programs

Apart from debt settlement companies, there are also reputable debt settlement programs offered by non-profit organizations and credit counseling agencies. These programs can provide guidance and resources to negotiate settlements with creditors on your own.

Research and compare different programs to find the one that suits your needs and financial situation. Look for programs with a track record of success and a commitment to helping individuals achieve debt relief.

Calculate Your Ideal Settlement Amount

Analyze Your Finances

Before initiating settlement negotiations, it’s important to conduct a thorough analysis of your finances. Take a close look at your income, expenses, and any potential changes in your financial situation. Understanding your financial position will help you determine a realistic settlement amount.

Determine an Affordable Settlement

When planning your settlement amount, consider what you can genuinely afford to pay. Take into account your monthly income, expenses, and other financial obligations. Ideally, your settlement amount should enable you to comfortably meet your payment obligations while still managing your day-to-day expenses.

Consider Your Payment Capabilities

Assess your ability to make a lump-sum payment or agree on a structured repayment plan. If your financial situation allows, a lump-sum payment may help you negotiate a more substantial settlement. However, if a lump-sum payment is not feasible, explore the possibility of an installment plan that fits your budget.

Negotiate a Reasonable Payoff Amount

When initiating settlement negotiations, aim to negotiate a reasonable payoff amount that is less than what you currently owe. Be prepared to support your proposed settlement amount with evidence of your financial constraints. This evidence may include bank statements, pay stubs, or any other documents that demonstrate your inability to meet the full debt obligation.

Remember, negotiation is a two-way process. Be prepared for counteroffers from your creditors and approach the process with flexibility and patience.

Prioritize Your Debts

Identify High-Priority Debts

When dealing with multiple debts, it’s crucial to prioritize them strategically. High-priority debts typically include those with higher interest rates or those that may lead to severe consequences if left unpaid, such as tax debts or legal obligations.

By prioritizing high-priority debts, you can focus your resources and negotiation efforts on resolving the most critical financial obligations first.

Consider the Impact of Interest Rates

Interest rates play a significant role in determining the cost of your debts over time. Higher interest rates can quickly escalate your debt burden and make it harder to negotiate settlements. Be aware of the interest rates on your debts and consider prioritizing those with the highest rates.

By settling debts with high-interest rates initially, you can reduce the overall cost of your debt and potentially free up more resources for negotiating settlements on other debts.

Allocate Available Resources Strategically

Managing your available resources strategically is essential when negotiating debt settlements. Consider how much money you can allocate towards settlements each month and distribute it among your prioritized debts. By focusing your resources on a few debts at a time, you increase the likelihood of reaching favorable settlements.

Manage Unpaid Debts with Collections Agencies

In some cases, your debts may have been sold or transferred to collections agencies. It’s important to address these unpaid debts promptly. Engage with collections agencies, verify the debts they claim you owe, and negotiate settlements directly with them if necessary. Resolving debts with collections agencies can help you prevent further legal actions or negative consequences.

Build a Repayment Strategy

Create a Budget

When negotiating and paying off your debts, having a budget is essential. A budget will allow you to allocate your income towards essential expenses, savings, and debt settlement payments. By tracking your expenses and sticking to a budget, you can ensure that you have enough money available to meet your settlement obligations.

Explore Debt Consolidation Options

Debt consolidation can be an effective strategy to simplify your debt repayment process. It involves combining multiple debts into a single loan with a lower interest rate or a structured repayment plan. By consolidating your debts, you can potentially reduce your overall monthly payments and make them more manageable.

Research different debt consolidation options, such as personal loans or balance transfer credit cards, to find the one that suits your needs.

Consider Negotiating with Creditors Directly

While debt settlement companies can be helpful, you may also choose to negotiate directly with your creditors. Reach out to your creditors, explain your financial situation honestly, and express your willingness to settle your debts. Many creditors are open to negotiation to recover some of the outstanding debt rather than risk not receiving anything if you file for bankruptcy.

Before negotiating with creditors directly, research their policies and look for any debt settlement programs they may offer. This will help you approach the negotiation process more confidently.

Explore Debt Management or Credit Counseling Programs

Debt management or credit counseling programs can provide you with professional guidance and strategies to negotiate settlements successfully. These programs typically involve working with a certified credit counselor who will review your financial situation and provide personalized advice.

If you feel overwhelmed by the negotiation process or need additional support, exploring debt management or credit counseling programs can be beneficial.

Communicate Effectively with Creditors

Establish Open Lines of Communication

Clear and open communication with your creditors is essential throughout the negotiation process. Establish a consistent and reliable method of communication, whether it’s through phone calls, emails, or written correspondence. Promptly respond to any inquiries or requests for information.

By maintaining an open line of communication, you can demonstrate your commitment to resolving your debts and increase the chances of reaching a favorable settlement.

Present Your Financial Situation Honestly

When communicating with creditors, honesty is crucial. Clearly explain your current financial situation, including any significant changes that may have impacted your ability to repay your debts. Provide supporting documentation, such as bank statements or proof of income, to substantiate your claims.

Being transparent about your situation can help creditors understand your position and potentially lead to more favorable settlement terms.

Explain Your Inability to Pay the Full Amount

When negotiating a debt settlement, it’s essential to clearly explain why you cannot pay the full amount owed. Highlight any financial hardships you are facing, such as job loss, medical expenses, or other unexpected circumstances. By demonstrating your financial limitations, you can justify your request for a reduced settlement amount.

Negotiate for Reduced Interest Rates or Fees

In addition to negotiating the overall debt settlement amount, consider requesting reduced interest rates or the elimination of fees. Lower interest rates can significantly reduce the cost of repaying your debts over time. Eliminating or reducing fees can also make your settlement more feasible and manageable.

Approach the negotiation process with confidence and be prepared to provide reasons why the reduction in interest rates or fees is warranted.

Understand the Debt Settlement Process

Comprehend the Steps Involved in Settlement

Having a clear understanding of the debt settlement process is crucial to navigating it effectively. Familiarize yourself with the typical steps involved, such as initial negotiations, sending settlement offers, reviewing and signing agreements, and making the required payments.

By knowing what to expect at each stage, you can better prepare yourself and avoid any surprises.

Understand the Impact on Credit Scores

It’s important to be aware of the potential impact that debt settlement may have on your credit score. Debt settlement can result in a temporary decrease in your credit score, but by consistently managing your finances and making timely payments, you can work towards rebuilding your credit.

Recognize that successfully negotiating settlement terms and fulfilling your obligations can ultimately help improve your credit score over the long term.

Be Aware of Potential Tax Implications

Debt settlement can have tax implications depending on the amount forgiven and your individual circumstances. It’s essential to consult a tax professional or financial advisor to understand the tax consequences specific to your situation. They can guide you in understanding whether you may have to report any forgiven debt as taxable income.

Tax implications can vary, so it’s important to seek personalized advice to ensure you are fully informed.

Seek Professional Advice if Necessary

Navigating the debt settlement process can be complex, especially if you have multiple debts or significant financial constraints. If you feel overwhelmed or unsure about specific aspects of debt settlement, consider seeking professional advice.

Consulting with a reputable financial advisor, attorney, or credit counselor can provide you with invaluable insights and guidance throughout the process.

Negotiate with Confidence

Prepare Yourself with Knowledge and Facts

Prior to entering negotiations, arm yourself with knowledge about your debts, financial situation, and applicable laws or regulations. Understand your rights as a debtor and the potential consequences for both you and your creditors if a settlement is not reached.

Gather all relevant documents, including account statements, payment history, and any correspondence related to your debts. Being well-prepared will give you the confidence to negotiate effectively.

Maintain a Calm and Respectful Demeanor

Maintaining a calm and respectful demeanor is critical during negotiation conversations. Keep in mind that the goal is to reach a mutually agreeable settlement. Getting emotionally charged or confrontational can hinder productive discussions and jeopardize the negotiation process.

Approach the negotiation with a cooperative attitude, listen to your creditors’ concerns, and respond thoughtfully to their offers or counteroffers.

Establish a Clear Objective

Set clear goals for your negotiation and clearly communicate them to your creditors. Decide on the maximum settlement amount you are willing to accept and any additional terms or conditions that are important to you.

Having a clear objective helps guide your negotiation strategy and ensures consistency in your decision-making.

Enlist the Help of a Professional Negotiator If Needed

If you find negotiating with creditors challenging or feel overwhelmed by the process, consider enlisting the help of a professional negotiator. Professional negotiators, such as attorneys or debt settlement specialists, have experience in dealing with creditors and can advocate for your best interests.

While there may be associated fees, the assistance of a professional negotiator can potentially lead to more favorable settlement terms and a smoother negotiation process.

Document and Review Agreement Terms

Ensure All Settlement Terms Are in Writing

Once you reach a settlement agreement with your creditors, it is crucial to ensure that all the agreed-upon terms are documented in writing. A written agreement provides legal protection and serves as evidence of the settlement terms.

Review the document carefully and verify that all the essential details, such as the total settlement amount, payment terms, and any additional conditions, are accurately stated.

Review and Understand All Clauses

Take the time to carefully review all clauses and provisions in the agreement. Understand any potential obligations or limitations outlined in the document. If there is any language that you find confusing or ambiguous, seek clarification from your creditors or a legal professional.

Knowing and understanding the agreement terms will help you fulfill your obligations and avoid any potential disputes or misunderstandings.

Seek Legal Advice for Complex Settlements

If your settlement involves complex financial or legal issues, seeking legal advice is advisable. Certain settlements may have implications that require a thorough understanding of the law. A qualified attorney can provide you with guidance specific to your situation and ensure that your rights are protected.

Complex settlements can have long-term consequences, so investing in legal advice can be invaluable in protecting your interests.

Keep Copies of All Documents and Correspondence

Throughout the debt settlement process, it is essential to maintain organized records of all documents and correspondence related to your negotiations. Keep copies of settlement offers, counteroffers, agreements, and any other relevant documents.

Having a comprehensive record will help you track your progress, respond to any inquiries or disputes, and provide evidence if needed in the future.

Follow Through and Fulfill Settlement Obligations

Pay the Agreed Settlement Amount Promptly

Once you have reached a settlement agreement, it is crucial to fulfill your payment obligations promptly. Adhere to the agreed-upon payment schedule and ensure that all payments are made on time. This demonstrates your commitment to honoring the settlement agreement.

By staying consistent with your payments, you can maintain the trust of your creditors and effectively work towards becoming debt-free.

Monitor Creditors’ Compliance with the Agreement

After initiating the settlement, continue monitoring your creditors’ compliance with the agreement. Keep track of your payments, ensure they are correctly applied to your outstanding balance, and request regular statements or updates from your creditors.

If you notice any discrepancies or issues, promptly address them with your creditors and work towards a resolution.

Maintain Records of All Settlement Payments

Keep detailed records of all settlement payments you make. This includes copies of checks, transaction receipts, or any other evidence of payment. Maintaining organized records will help you track your progress, provide proof of payment if needed, and ensure accuracy in your financial records.

Adjust Your Budget to Fulfill Repayment Obligations

To successfully fulfill your settlement obligations, make any necessary adjustments to your budget. Reallocate resources to accommodate your settlement payments and ensure that you have sufficient funds available each month.

By adapting your budget, you can effectively manage your financial obligations and work towards achieving your debt-free goals.

Negotiating debt settlements can be a challenging journey, but by understanding your debt, educating yourself, and following a comprehensive strategy, you can regain control of your financial situation. Remember, stay proactive, communicate effectively, and prioritize your debts strategically. With dedication and perseverance, you can pave the way to a debt-free future.

© 2015-2023 by burdenofdebt.com, a LIVenture. All rights reserved. No part of this document may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of LiVentures LLC.