Understanding The Psychology Of Debt And How To Overcome It

Are you feeling overwhelmed by your debt? Do you find yourself struggling to make ends meet, constantly worried about your financial future? This article is specifically designed to provide you with valuable insights and strategies that can empower you to take control of your debt and improve your financial well-being. With a comprehensive understanding of the psychological factors at play when it comes to debt, you will be equipped to make informed decisions and navigate your way to a debt-free future. Say goodbye to sleepless nights and hello to financial freedom with “Understanding The Psychology Of Debt And How To Overcome It.”

The Psychology of Debt

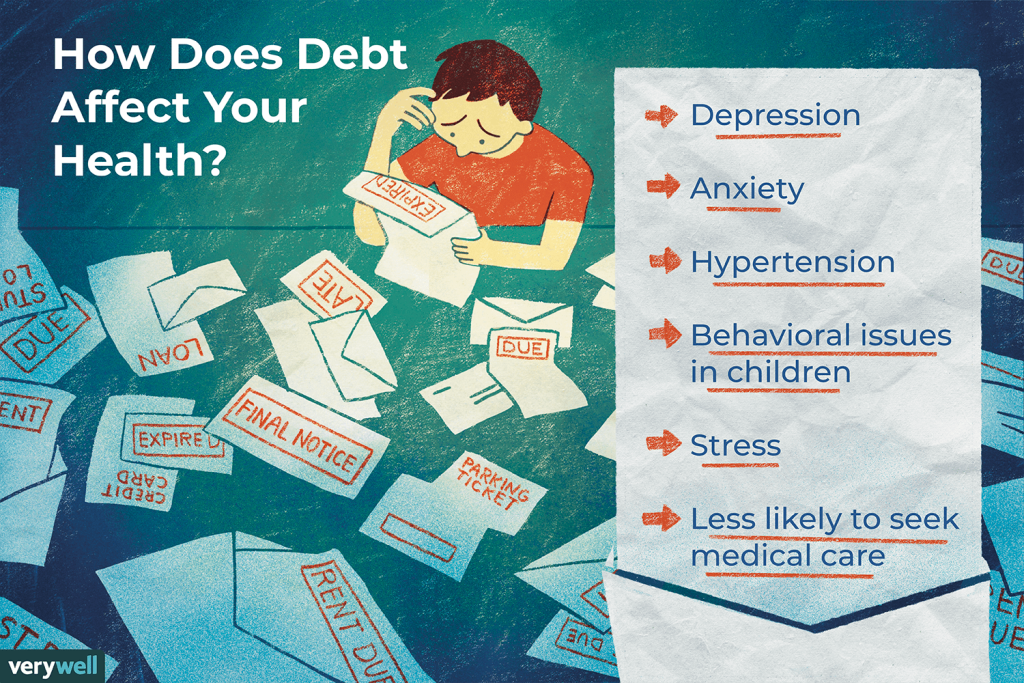

The emotional impact of debt

Debt can have a significant emotional impact on individuals and families. The burden of owing money can lead to feelings of stress, anxiety, and even depression. The constant worry about making payments and the fear of falling further behind can take a toll on one’s mental well-being. Additionally, the shame and guilt associated with being in debt can further compound these negative emotions. It is essential to recognize and address these emotional impacts to effectively overcome debt.

The mindset of debt

The mindset of debt plays a crucial role in how individuals approach and handle their financial obligations. Some individuals may view debt as a necessary tool to achieve their goals, while others may see it as a burden that weighs them down. The mindset of debt can also impact one’s financial decision-making, such as engaging in impulsive spending or avoiding confronting the reality of the debt. Understanding and shifting one’s mindset towards a more positive and proactive approach can help individuals regain control of their financial situation.

The influence of societal norms on debt

Societal norms and expectations can have a significant influence on one’s relationship with debt. In many cultures, there is a prevailing belief that taking on debt is a normal and even desirable part of life. This perception can lead individuals to accumulate more debt than they can comfortably manage. It is important to challenge these societal norms and evaluate the true impact of debt on one’s financial and emotional well-being. By questioning and reevaluating these societal beliefs, individuals can make more informed and responsible financial decisions.

The psychological effects of debt stress

Debt stress refers to the psychological strain caused by the burden of indebtedness. This stress can manifest in various ways, including increased levels of anxiety, difficulty concentrating, and disrupted sleep patterns. Debt stress can also lead to strained relationships, as financial problems often create tension and conflict within households. Addressing and managing debt stress is essential for both physical and mental health. Through effective debt management strategies, individuals can alleviate stress and regain a sense of control over their financial situation.

Identifying Debt Triggers

Understanding personal spending habits

Understanding personal spending habits is a crucial step in identifying the triggers that lead to accumulating debt. Take the time to analyze your spending patterns and identify any patterns of overspending or unnecessary purchases. By recognizing these habits, you can start to develop strategies to address and modify them.

Recognizing emotional spending triggers

Emotional spending refers to the impulse to make purchases driven by emotions rather than practical needs. Understanding and recognizing emotional spending triggers is essential in breaking the cycle of overspending. Common emotional triggers include stress, boredom, sadness, and even happiness. By identifying these emotional triggers, you can develop alternative coping mechanisms to avoid unnecessary spending.

Identifying external triggers

External triggers are external influences that contribute to overspending and debt accumulation. These triggers can include advertising, peer pressure, or societal expectations. For example, constantly being bombarded by advertisements for the latest gadgets may tempt you to make impulsive purchases. By identifying these external triggers, you can become more mindful of their influence and make conscious choices to avoid falling into unnecessary debt.

Exploring the link between emotions and debt

There is a strong link between emotions and the accumulation of debt. Emotions such as stress, anxiety, and low self-esteem can drive individuals to make impulsive financial decisions or engage in excessive spending. It is important to explore and understand this emotional connection to effectively manage and overcome debt. By addressing the underlying emotions, individuals can develop healthier money habits and make more rational financial decisions.

Debt Denial and Avoidance Behaviors

Signs of debt denial

Debt denial is a common defense mechanism where individuals consciously or unconsciously avoid acknowledging their financial situation. Signs of debt denial may include ignoring bills and collection notices, avoiding conversations about money, and maintaining a lifestyle beyond one’s means. Recognizing these signs of denial is the first step in breaking free from its grasp.

The psychology behind debt avoidance

Debt avoidance behavior is often driven by fear and anxiety. Individuals may be afraid of facing the reality of their financial situation or feel overwhelmed by the prospect of dealing with their debts. Debt avoidance can manifest in procrastination, ignoring financial responsibilities, and engaging in self-destructive financial habits. Understanding the psychology behind debt avoidance is crucial for overcoming it and taking proactive steps towards debt repayment.

Consequences of avoiding debt

Avoiding debt may provide temporary relief from the stress associated with financial obligations. However, the long-term consequences of debt avoidance can be detrimental. Late payments, collection actions, and damaged credit can have long-lasting effects on one’s financial health. Additionally, the emotional toll of living in constant denial can further deteriorate mental well-being and strain relationships. It is essential to confront debt avoidance to avoid these negative consequences.

Breaking the cycle of debt denial

Breaking the cycle of debt denial requires a willingness to face the reality of one’s financial situation. Acknowledge the debts, gather all necessary information, and seek support from trusted individuals or professionals. By taking proactive steps and developing a plan for debt repayment, individuals can break free from the cycle of denial and regain control over their finances.

Developing a Debt Repayment Strategy

Setting realistic goals

Setting realistic goals is crucial when developing a debt repayment strategy. Start by assessing your financial situation, including your income, expenses, and debts. Determine how much you can reasonably allocate towards debt repayment each month. Set achievable goals that align with your financial capabilities to maintain motivation and progress towards debt freedom.

Creating a budget

Creating a budget is an effective tool for managing and reducing debt. Track your income and expenses to gain a clear understanding of where your money is going. Identify areas where you can cut back on spending and redirect those funds towards debt repayment. A well-planned budget will help you stay on track and make consistent progress towards your debt repayment goals.

Prioritizing debts

When facing multiple debts, it is essential to prioritize which debts to focus on first. Two common approaches to prioritizing debts are the “debt snowball” method and the “debt avalanche” method. In the debt snowball method, you start by paying off the smallest debts first, while in the debt avalanche method, you prioritize debts with the highest interest rates. Choose the approach that aligns best with your financial situation and goals.

Exploring debt consolidation options

Debt consolidation can be a useful strategy for managing multiple debts and simplifying repayment. Consolidating debts involves combining multiple debts into a single loan with a lower interest rate or more favorable terms. This can help lower monthly payments and make debt repayment more manageable. However, it is important to carefully consider the terms and potential fees associated with debt consolidation options before proceeding.

Addressing Emotional Challenges

Confronting shame and guilt

Debt often comes with feelings of shame and guilt, which can be emotionally challenging to overcome. Confronting these emotions is a vital step towards healing and building a healthier relationship with money. Understand that debt does not define your worth as a person and that many others have faced similar challenges. Seek support from loved ones, financial counselors, or therapists who can help you process these emotions and move forward.

Building self-worth and resilience

Building self-worth and resilience is crucial for overcoming the emotional challenges of debt. Recognize and celebrate your accomplishments, no matter how small, along your debt repayment journey. Practice self-care and engage in activities that can boost your self-esteem and well-being. Building resilience will help you navigate setbacks and stay motivated throughout the debt repayment process.

Seeking emotional support

Seeking emotional support is essential when facing the emotional challenges of debt. Reach out to trusted friends, family members, or support groups to share your experiences and receive guidance. Consider seeking professional counseling or therapy to address any deep-rooted emotional issues related to debt. Remember that you do not have to face these challenges alone and that there is support available to help you through difficult times.

Changing negative thought patterns

Negative thought patterns, such as self-blame or a sense of hopelessness, can hinder progress towards overcoming debt. It is important to challenge and change these negative thought patterns to foster a more positive mindset. Practice positive affirmations, engage in positive self-talk, and focus on the progress you have made rather than dwelling on past mistakes. By changing your thought patterns, you can cultivate a more optimistic outlook and approach towards debt repayment.

Behavioral Techniques to Overcome Debt

Cognitive Behavioral Therapy (CBT)

Cognitive Behavioral Therapy (CBT) is a therapeutic approach that helps individuals identify and change negative thought patterns and behaviors. CBT can be particularly beneficial in overcoming debt-related stress, anxiety, and impulsive spending habits. A qualified therapist can help you develop healthier coping mechanisms and equip you with the necessary skills to manage and overcome debt effectively.

The snowball method

The snowball method is a debt repayment strategy that involves paying off debts in order from smallest to largest, regardless of interest rates. This approach focuses on gaining momentum and motivation by paying off smaller debts first, leading to a sense of accomplishment. As each debt is paid off, the funds previously allocated towards it can be redirected towards the next debt, ultimately accelerating the debt repayment process.

Delayed gratification techniques

Delayed gratification techniques involve resisting immediate impulses and focusing on long-term goals. Instead of giving in to impulsive spending, practice delaying gratification by waiting for a set period before making a purchase. This allows time for reflection and consideration, reducing the likelihood of impulsive buying decisions. By adopting delayed gratification techniques, you can regain control over your spending habits and allocate more funds towards debt repayment.

Tracking expenses and progress

Tracking expenses and progress is a crucial aspect of successful debt repayment. Keep a detailed record of your income, expenses, and debt repayment progress. Regularly reviewing this information will help you stay accountable and identify areas for improvement. Tracking your expenses also provides valuable insights into your spending habits and allows you to make informed decisions about where to cut back and allocate additional funds towards debt repayment.

The Role of Education and Financial Literacy

Understanding the impact of interest rates

Understanding the impact of interest rates is essential for making informed financial decisions. High-interest rates can significantly increase the overall cost of debts and make debt repayment more challenging. Educate yourself on how interest rates work and explore options to negotiate lower rates or refinance existing loans to reduce interest expenses.

Learning about credit scores and reports

Credit scores and reports play a critical role in financial well-being and access to credit. Educate yourself on how credit scores are calculated and the factors that contribute to a good credit score. Regularly review your credit reports to identify any inaccuracies or areas for improvement. Improving your credit score can lead to better loan terms, lower interest rates, and increased financial opportunities.

Building financial knowledge and skills

Building financial knowledge and skills is key to effectively managing debt and achieving long-term financial stability. Take advantage of educational resources such as books, online courses, and workshops to enhance your financial literacy. Learn about budgeting, saving, investing, and other important financial concepts. The more knowledge and skills you acquire, the better equipped you will be to make informed financial decisions and overcome debt.

Seeking professional financial guidance

Seeking professional financial guidance can provide valuable insights and assistance in managing debt. Consider consulting with a financial advisor or credit counselor who can provide tailored advice based on your specific financial situation. They can help you develop a personalized debt repayment plan, explore debt relief options, and offer strategies for long-term financial success. Professional guidance can be particularly beneficial if you feel overwhelmed or unsure about how to navigate your debt journey.

Building a Healthy Relationship with Money

Identifying and challenging money beliefs

Identifying and challenging deeply ingrained money beliefs is essential for building a healthy relationship with money. Reflect on the beliefs and attitudes towards money that you have developed over time. Consider whether these beliefs are serving you or holding you back from financial progress. Challenge any negative or limiting money beliefs and replace them with empowering and positive perspectives that align with your financial goals.

Practicing mindful spending

Practicing mindful spending involves being intentional and aware of how and why you spend your money. Before making a purchase, pause and ask yourself if it aligns with your financial goals and values. Consider the long-term impact of your spending decisions and whether the item or experience will bring genuine value to your life. Mindful spending helps you make conscious and informed choices, reducing the likelihood of impulsive or unnecessary purchases.

Cultivating gratitude and contentment

Cultivating gratitude and contentment can help shift your focus from material possessions to appreciating what you already have. Gratitude encourages a sense of fulfillment and reduces the desire for excessive consumption. Take time each day to reflect on the things you are grateful for, no matter how small. By cultivating gratitude and contentment, you can find joy in simplicity and prioritize financial well-being over material accumulation.

Fostering long-term financial well-being

Building a healthy relationship with money involves adopting long-term financial habits that support your financial well-being. Set clear financial goals and develop a plan to achieve them. Regularly review and adjust your budget, savings, and investment strategies to align with your goals. Prioritize saving for emergencies and investing for long-term financial security. By fostering long-term financial well-being, you can build a solid foundation for a stable and prosperous future.

Overcoming Impulsive Spending

Recognizing impulsive spending patterns

Recognizing impulsive spending patterns is crucial for overcoming this destructive behavior. Take note of situations or emotions that often trigger impulsive buying decisions. Identify any recurring patterns or habits that lead to excessive spending. By becoming aware of your impulsive spending patterns, you can interrupt the cycle and develop strategies to redirect those urges towards healthier financial choices.

Exploring underlying emotions

Impulsive spending is often driven by underlying emotions, such as stress, loneliness, or a desire for instant gratification. Take the time to explore and understand these underlying emotions. Find alternative ways to address and manage these emotions without resorting to impulsive spending. For example, engaging in physical activity, practicing mindfulness or seeking social support can help alleviate emotional triggers and reduce impulsive spending.

Implementing strategies to curb impulsive buying

Implementing strategies to curb impulsive buying requires a combination of self-awareness and proactive action. Start by establishing clear spending limits and sticking to a predetermined budget. Avoid situations or environments that tempt you to make impulsive purchases. Consider implementing a waiting period before making non-essential purchases to allow ample time for consideration. By implementing these strategies, you can regain control over impulsive spending habits and allocate more funds towards debt repayment.

Building positive financial habits

Overcoming impulsive spending involves replacing negative habits with positive financial habits. Develop a routine of reviewing your finances regularly, setting savings goals, and tracking your expenses. Automate savings contributions and debt repayments to ensure consistency. Reward yourself for meeting financial milestones or staying within your budget. By building positive financial habits, you can transform your relationship with money and achieve greater financial freedom.

Creating a Supportive Environment

Communicating with loved ones about debt

Open and honest communication with loved ones about debt is essential for creating a supportive environment. Share your financial goals and challenges with trusted family members or friends who can provide understanding and encouragement. Discuss ways in which they can support your debt repayment journey, such as avoiding activities that may tempt you to overspend or offering emotional support during challenging times. By involving loved ones, you create a network of support that strengthens your resolve to overcome debt.

Developing a network of support

Developing a network of support goes beyond family and friends. Seek out support groups or online communities of individuals who are also working towards overcoming debt. These groups provide a safe space to share experiences, exchange advice, and gain motivation from others on a similar journey. Connecting with individuals who understand your struggles and can offer guidance can be invaluable during the debt repayment process.

Surrounding oneself with positive influences

Surrounding yourself with positive influences is crucial when overcoming debt. Avoid individuals or environments that encourage excessive spending or perpetuate unhealthy financial habits. Instead, seek out individuals who inspire and motivate you to make responsible financial decisions. Surrounding yourself with positive influences fosters a mindset of growth and financial well-being, increasing your chances of successfully overcoming debt.

Avoiding triggers and temptations

Identifying and avoiding triggers and temptations is essential for creating a supportive environment. Analyze situations or environments that often lead to impulsive buying decisions or unnecessary spending. Adjust your routines or habits to minimize exposure to these triggers. For example, if online shopping is a temptation, consider unsubscribing from promotional newsletters or disabling shopping apps on your devices. By actively avoiding triggers and temptations, you create a space that supports your debt repayment goals.

© 2015-2023 by burdenofdebt.com, a LIVenture. All rights reserved. No part of this document may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of LiVentures LLC.